AWS-1 Auction Day 8 – SupaLicenses

There was no bids at all today on the Supa-Licenses; yesterday, there was only one bid. It therefore seems sensible to review the status before the Auction moves into Stage 2 and possibly the action starts to pick up again.

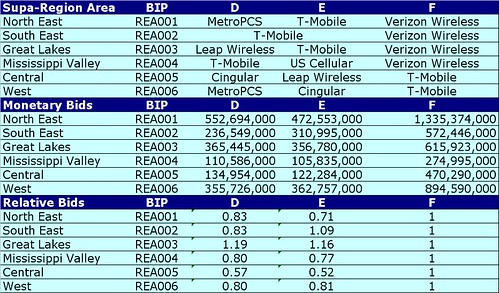

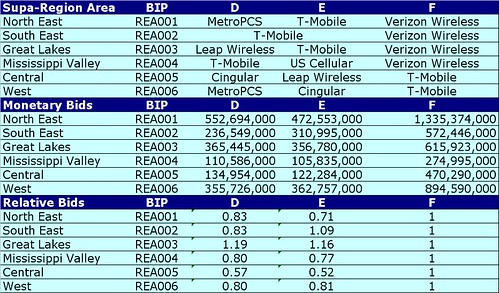

The first thing to notice is that the licenses are dominated by T-Mobile and Verizon Wireless. Currently, T-Mobile has full lower-48 state coverage with 20MHz in 3 of the areas and 10MHz in the other 3. Verizon Wireless has 20MHz in 4 of the 6 markets. Effectively, T-Mobile can still bid on all the regions and have enough bidding units to push for 20MHz in all the regions if they so desire.

However, Verizon Wireless does not have enough bidding units left for 20MHz for each lower 48 market. Currently Verizon Wireless is pretty quiet - they haven't made a single bid in 3 days or 12 rounds. On Monday, I think the auction will move into Stage 2 and because of the change in activity rules, Verizon Wireless will be forced to reveal its’ hand. In stage 2 each bidder is required to bid 95% of eligible bidding units rather than the 80% currently permitted. I believe Verizon Wireless has five options:

i) Stick with the licenses and spectrum they currently have and/or defend the licenses if someone else bids;

ii) Bid on 20MHz in the Central region;

iii) Bid on 10MHz in Central and 10MHz in the West;

iv) Move into specific markets in the CMA and BEA bands; or

v) Look to make an acquisition outside of the auction.

Effectively the decisions made by T-Mobile and Verizon Wireless will be driven by the other potential regional license holders:

• Cingular holds the largest amount of spectrum already and whatever decision they make will not make them a bigger threat than they are already. Cingular doesn’t have enough bidding units to prevent T-Mobile getting the nationwide license.

• MetroPCS is financed by the Private Equity industry and is a relatively niche player with around 2m customers in Atlanta, Miami, Tampa, San Francisco, Sacramento and Detroit. I am really surprised they are bidding in the supa-regional licenses and even thinking of a major build-out in a new area for MetroPCS like the North East. As well as bidding US$908m on two 10MHz supa-regions, MetroPCS has also bid US$248m for the biggest 10MHz BEA license available in New York and New Jersey. It is anyone’s guess how much money the Private Equity people are prepared to pump-in, but I think the incumbents will want to keep another new player out of these markets. There is another wild-card is as much as I’m sure the Private Equity people will also quite happily trade the spectrum or even sell the company to a buyer. MetroPCS is a CDMA operator.

• Leap Wireless is also interesting because they normally operate in secondary markets and target a different market segment than Verizon Wireless - they basically serve the “value conscious consumer” or someone looking for a bargain. They are a quoted company with US$2.6bn of turnover, made US$25m of profits in the first six months of 2006, have low overheads and also operate a CDMA network. In short they are hardly a threat to Verizon, Cingular and T-Mobile and they could be a potential purchase for Verizon in future years. Somehow, Leap is getting a start-up credit for bidding in the name of Denali.

• The final bidder left on the Supa-Licenses is a strange start-up called Barat who are actually controlled by US Cellular who in themselves are a pretty strange company and already operate out of Chicago – and again hardly a threat.

In summary the only bidder left in the Supa-licensees who could potentially upset the current status-quo is MetroPCS. The auction will probably move into Stage 2 on Monday where Verizon Wireless will be forced to reveal its’ hand for the end game.

The first thing to notice is that the licenses are dominated by T-Mobile and Verizon Wireless. Currently, T-Mobile has full lower-48 state coverage with 20MHz in 3 of the areas and 10MHz in the other 3. Verizon Wireless has 20MHz in 4 of the 6 markets. Effectively, T-Mobile can still bid on all the regions and have enough bidding units to push for 20MHz in all the regions if they so desire.

However, Verizon Wireless does not have enough bidding units left for 20MHz for each lower 48 market. Currently Verizon Wireless is pretty quiet - they haven't made a single bid in 3 days or 12 rounds. On Monday, I think the auction will move into Stage 2 and because of the change in activity rules, Verizon Wireless will be forced to reveal its’ hand. In stage 2 each bidder is required to bid 95% of eligible bidding units rather than the 80% currently permitted. I believe Verizon Wireless has five options:

i) Stick with the licenses and spectrum they currently have and/or defend the licenses if someone else bids;

ii) Bid on 20MHz in the Central region;

iii) Bid on 10MHz in Central and 10MHz in the West;

iv) Move into specific markets in the CMA and BEA bands; or

v) Look to make an acquisition outside of the auction.

Effectively the decisions made by T-Mobile and Verizon Wireless will be driven by the other potential regional license holders:

• Cingular holds the largest amount of spectrum already and whatever decision they make will not make them a bigger threat than they are already. Cingular doesn’t have enough bidding units to prevent T-Mobile getting the nationwide license.

• MetroPCS is financed by the Private Equity industry and is a relatively niche player with around 2m customers in Atlanta, Miami, Tampa, San Francisco, Sacramento and Detroit. I am really surprised they are bidding in the supa-regional licenses and even thinking of a major build-out in a new area for MetroPCS like the North East. As well as bidding US$908m on two 10MHz supa-regions, MetroPCS has also bid US$248m for the biggest 10MHz BEA license available in New York and New Jersey. It is anyone’s guess how much money the Private Equity people are prepared to pump-in, but I think the incumbents will want to keep another new player out of these markets. There is another wild-card is as much as I’m sure the Private Equity people will also quite happily trade the spectrum or even sell the company to a buyer. MetroPCS is a CDMA operator.

• Leap Wireless is also interesting because they normally operate in secondary markets and target a different market segment than Verizon Wireless - they basically serve the “value conscious consumer” or someone looking for a bargain. They are a quoted company with US$2.6bn of turnover, made US$25m of profits in the first six months of 2006, have low overheads and also operate a CDMA network. In short they are hardly a threat to Verizon, Cingular and T-Mobile and they could be a potential purchase for Verizon in future years. Somehow, Leap is getting a start-up credit for bidding in the name of Denali.

• The final bidder left on the Supa-Licenses is a strange start-up called Barat who are actually controlled by US Cellular who in themselves are a pretty strange company and already operate out of Chicago – and again hardly a threat.

In summary the only bidder left in the Supa-licensees who could potentially upset the current status-quo is MetroPCS. The auction will probably move into Stage 2 on Monday where Verizon Wireless will be forced to reveal its’ hand for the end game.

<< Home