AWS-1 Auction - Day 6 Summary

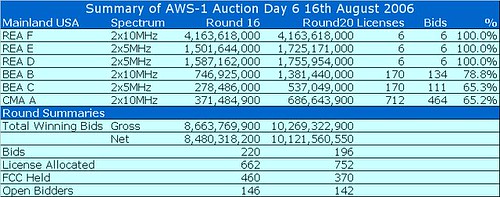

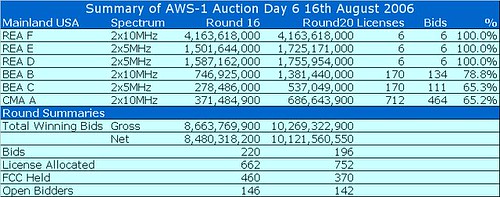

Today, there was very little action on the supa-regional D/E/F bands: 0 bids on the “F” band; 3 on the “D”; and 6 on the “E”. Verizon Wireless didn’t make a single bid all day. However, the total number of bids on Day 6 was higher than on other day apart from the initial day. This is because today was all about reducing the price differential between the A/B/C bands and the D/E/F bands. With the differential on the key A and C bands still standing at 6.06x and 3.9x, as opposed to 11.2x and 7.5x yesterday, realistically I expect tomorrow to be another day of “differential reduction”

The U.S. Treasury will not be crying too much - they still raised an additional US$1,641,242,350 in the day.

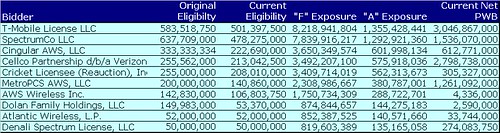

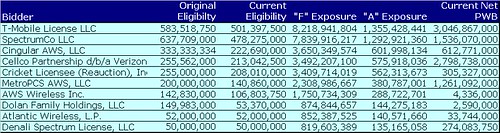

In terms of Cingular, they have joined Verizon Wireless in having less bidding units left than is required to buy 20MHz of mainland USA license. So only T-Mobile and SpectrumCo are left with more than enough bidding units left to buy a nationwide license.

We are getting to the stage in the auction that the major bidders remaining (ie Verizon Wireless, Cingular, SpectrumCo and T-Mobile) are looking at the medium sized bidders and trying to figure out how much they can really afford to continue bidding.

I suspect that overall Cingular and Verizon Wireless are well within budget and can afford it if the prices go a lot higher. I also suspect that T-Mobile who with their current availability could gain at a maximum around 40MHz of nationwide spectrum can afford the price even on the “F” exposure figure. The wild card is SpectrumCo – who knows the details of the partnership agreement, let alone the strategic thinking of the partnership.

Leap Wireless the backer of Cricket and Denali announced today it would raise an addition US$250m in equity. However, its exposure is much greater than this and Leap is already heavily geared. The big players will have already spent a lot of money doing an analysis of Leap Wireless and the other medium sized bidders – how much can they really afford? When I say afford, I mean not only spectrum costs but also rollout and launch costs in new markets.

After all, when Nextwave bid a huge amount in previous auctions and ultimately went bankrupt and the spectrum went unused for many a year, the only real winners were the incumbents in the Nextwave regions.

The U.S. Treasury will not be crying too much - they still raised an additional US$1,641,242,350 in the day.

In terms of Cingular, they have joined Verizon Wireless in having less bidding units left than is required to buy 20MHz of mainland USA license. So only T-Mobile and SpectrumCo are left with more than enough bidding units left to buy a nationwide license.

We are getting to the stage in the auction that the major bidders remaining (ie Verizon Wireless, Cingular, SpectrumCo and T-Mobile) are looking at the medium sized bidders and trying to figure out how much they can really afford to continue bidding.

I suspect that overall Cingular and Verizon Wireless are well within budget and can afford it if the prices go a lot higher. I also suspect that T-Mobile who with their current availability could gain at a maximum around 40MHz of nationwide spectrum can afford the price even on the “F” exposure figure. The wild card is SpectrumCo – who knows the details of the partnership agreement, let alone the strategic thinking of the partnership.

Leap Wireless the backer of Cricket and Denali announced today it would raise an addition US$250m in equity. However, its exposure is much greater than this and Leap is already heavily geared. The big players will have already spent a lot of money doing an analysis of Leap Wireless and the other medium sized bidders – how much can they really afford? When I say afford, I mean not only spectrum costs but also rollout and launch costs in new markets.

After all, when Nextwave bid a huge amount in previous auctions and ultimately went bankrupt and the spectrum went unused for many a year, the only real winners were the incumbents in the Nextwave regions.

<< Home