Q2: UK Mobile Market Wrap-Up

I knocked up a quick chart showing the trends in the UK Mobile Market, but before the analysis a couple of notes of caution:

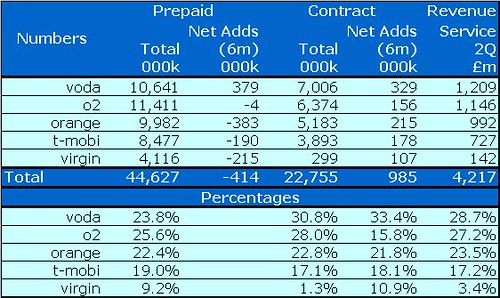

What is apparent is the speed that O2 service revenues are catching up to Voda's. However with Voda taking much more market share in net adds for both pre and post paid for the half year, I’d be extremely surprised if Voda didn’t finish 2008 still in the lead on the service revenue front.

The promotion of the quarter is definitely the O2 Simplicity deal which appears to be pushing its prepaid base into taking sim-only contracts. Personally, I think this is a great idea and will undoubtedly be copied by the other networks. I think the offer could also be slightly developed and offer tenure-based discounts on new handsets – this will drive traffic into the operator stores and promote loyalty. This is the approach that Sky is taking on flogging HD boxes and every operator in the UK would love for Sky-like churn figures.

The other interesting development in the quarter was the axing of the BT Movio mobileTV service as retailed by Virgin Mobile. Personally, I think this is a shame and is probably an indicator that DVB-H will eventually win out as the standard in the UK. For the other operators, they will be grateful to one less potential buyer of spectrum in the forthcoming L-Band auction.

Virgin Mobile has a new boss, but I think he will have his work cut out to improve margins and the customer base at the company. It is easy to provide a short term impetus to earnings by effectively shutting down a vast swathe of distribution to concentrate on direct sales to the cableTV base. Virgin Mobile is probably facing a long decline in the base unless they start pushing prepaid again.

The big surprise to me was Carphone’s continued growth in distribution despite nearly all the operators claiming direct connections are at a high. All I can think of to explain this phenomena is that Carphone is taking market share from the other mobile retailers such as Phones4U. It just goes to show the continued excellence of Carphone in retailing both on the High Street and Online. I did have to laugh at the Rene Obermann comments about one UK retailer being exceptionally aggressive in the quarter.

T-Mobile are a bit of an enigma at the moment with them cutting the value in the Flext package and also facing the initial wave of Flext contracts from the launch 18-months ago starting to expire. I suppose if things get really scary and they start losing some of the contract base, Carphone will gladly help them out in acquiring new customers at the right commission level.

3UK have also been quite quiet in the marketplace, but I think this is more a feature of the success of the X-Series and them not having to put other offers into the market. The key focus for them is the battle with OFCOM over termination fees, a victory in this is an absolute must.

- 3UK figures are not released yet and these are more important to the UK market than Virgin Mobile

- Voda have stopped recording the inactive numbers, so have a different way of counting the base than the rest

- Voda and O2 exclude their MVNO operations from the subscriber count

- I have assumed all the Virgin Mobile base, both prepaid and contract, are counted within the T-Mobi prepaid numbers. The T-Mobi numbers will also include figures from their smaller MVNOs such as Fresh.

- O2 and T-Mobi only state their revenue figures in €’s and therefore I have converted them using the average exchange rate used by Orange during the quarter.

What is apparent is the speed that O2 service revenues are catching up to Voda's. However with Voda taking much more market share in net adds for both pre and post paid for the half year, I’d be extremely surprised if Voda didn’t finish 2008 still in the lead on the service revenue front.

The promotion of the quarter is definitely the O2 Simplicity deal which appears to be pushing its prepaid base into taking sim-only contracts. Personally, I think this is a great idea and will undoubtedly be copied by the other networks. I think the offer could also be slightly developed and offer tenure-based discounts on new handsets – this will drive traffic into the operator stores and promote loyalty. This is the approach that Sky is taking on flogging HD boxes and every operator in the UK would love for Sky-like churn figures.

The other interesting development in the quarter was the axing of the BT Movio mobileTV service as retailed by Virgin Mobile. Personally, I think this is a shame and is probably an indicator that DVB-H will eventually win out as the standard in the UK. For the other operators, they will be grateful to one less potential buyer of spectrum in the forthcoming L-Band auction.

Virgin Mobile has a new boss, but I think he will have his work cut out to improve margins and the customer base at the company. It is easy to provide a short term impetus to earnings by effectively shutting down a vast swathe of distribution to concentrate on direct sales to the cableTV base. Virgin Mobile is probably facing a long decline in the base unless they start pushing prepaid again.

The big surprise to me was Carphone’s continued growth in distribution despite nearly all the operators claiming direct connections are at a high. All I can think of to explain this phenomena is that Carphone is taking market share from the other mobile retailers such as Phones4U. It just goes to show the continued excellence of Carphone in retailing both on the High Street and Online. I did have to laugh at the Rene Obermann comments about one UK retailer being exceptionally aggressive in the quarter.

T-Mobile are a bit of an enigma at the moment with them cutting the value in the Flext package and also facing the initial wave of Flext contracts from the launch 18-months ago starting to expire. I suppose if things get really scary and they start losing some of the contract base, Carphone will gladly help them out in acquiring new customers at the right commission level.

3UK have also been quite quiet in the marketplace, but I think this is more a feature of the success of the X-Series and them not having to put other offers into the market. The key focus for them is the battle with OFCOM over termination fees, a victory in this is an absolute must.

<< Home