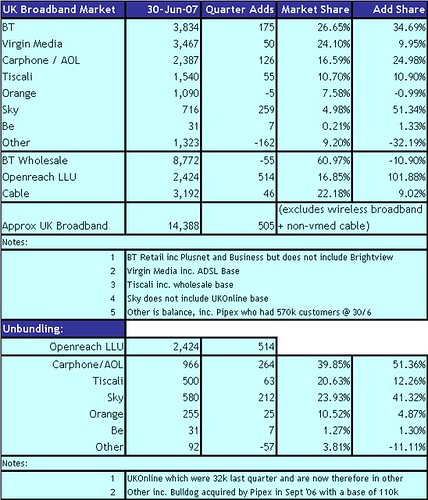

UK Broadband Market Summary Q2 2007

I can’t think of anything simpler than counting an ADSL customer: only one company at a time can use a copper pair and the final provisioning is controlled by a third party - either Openreach (LLU) or BT Wholesale (ipstream). However, the Q2 figures almost certainly show that an element of double counting is going on:

As far as I aware, Sky has not declared whether their figures include the UKOnline base which was 32k at the end of Q1. If the figures don’t than Sky net adds are even more remarkable.

BT despite pricing their services at a premium is still attracting a very good share of the overall market. I’m sure that this is not just because of the quality image, but also because competition in the rural areas is a lot less fierce, especially in non-LLUed and Cabled areas.

The Virgin Media share just keeps on drifting and this is despite the “claimed” top end package of 20-meg and the bargain basement £10/month 2-meg service without having to pay a line rental.

Carphone/TalkTalk/AOL appears to held their own during the month. Although the premium priced AOL seems to have faired a lot less well than the competitively priced TalkTalk. With the Free Laptop not kicking in until September and AOL priced extremely high in the non-LLU areas, I expect to see further drift in the AOL base in Q3.

Be is basically going nowhere and needs the brand relaunch by O2 which is due in October. O2 must be burning cash by the bucketload on this operation currently.

The lack of conversion of narrowband customers to broadband must also be a worry for both Orange and AOL. AOL narrowband base dropped 58k in the quarter to 447k and Orange by 124k to 915k. Neither of these drops were mirrored by increases in the broadband base. Remember that the Narrowband customers should be delivering huge margins at this period of their life cycle and it will be worrying the rapid drop off without going onto broadband.

Also, a big worry for the market will be the current lack of scale for Sky. I estimate that Sky need around 3m customers to make economic sense. At a run rate of 250k /quarter, Sky will continue piling the pressure for another 2-3 years and the Sky strategy is one of churning payTV customers from the other networks. Remember the majority of high income payTV customers will probably already be computer users and almost certainly will have some form of internet from another supplier.

With Sky’s strategy and the general dissatisfaction in the marketplace, I will be extremely surprised if overall market churn drops below 30% for the foreseeable future. The Openreach LLU stats show churn at around 30% for the LLU which is incredible give the high percentage which will still be in contract. I dread to think the current ipstream churn but current speculation puts it a lot higher than 30%.

Given the churn and the fact that deep-pocketed players such as O2 and Orange are still seriously sub-scale, I can’t see Broadband margins increasing for the foreseeable future…

As far as I aware, Sky has not declared whether their figures include the UKOnline base which was 32k at the end of Q1. If the figures don’t than Sky net adds are even more remarkable.

BT despite pricing their services at a premium is still attracting a very good share of the overall market. I’m sure that this is not just because of the quality image, but also because competition in the rural areas is a lot less fierce, especially in non-LLUed and Cabled areas.

The Virgin Media share just keeps on drifting and this is despite the “claimed” top end package of 20-meg and the bargain basement £10/month 2-meg service without having to pay a line rental.

Carphone/TalkTalk/AOL appears to held their own during the month. Although the premium priced AOL seems to have faired a lot less well than the competitively priced TalkTalk. With the Free Laptop not kicking in until September and AOL priced extremely high in the non-LLU areas, I expect to see further drift in the AOL base in Q3.

Be is basically going nowhere and needs the brand relaunch by O2 which is due in October. O2 must be burning cash by the bucketload on this operation currently.

The lack of conversion of narrowband customers to broadband must also be a worry for both Orange and AOL. AOL narrowband base dropped 58k in the quarter to 447k and Orange by 124k to 915k. Neither of these drops were mirrored by increases in the broadband base. Remember that the Narrowband customers should be delivering huge margins at this period of their life cycle and it will be worrying the rapid drop off without going onto broadband.

Also, a big worry for the market will be the current lack of scale for Sky. I estimate that Sky need around 3m customers to make economic sense. At a run rate of 250k /quarter, Sky will continue piling the pressure for another 2-3 years and the Sky strategy is one of churning payTV customers from the other networks. Remember the majority of high income payTV customers will probably already be computer users and almost certainly will have some form of internet from another supplier.

With Sky’s strategy and the general dissatisfaction in the marketplace, I will be extremely surprised if overall market churn drops below 30% for the foreseeable future. The Openreach LLU stats show churn at around 30% for the LLU which is incredible give the high percentage which will still be in contract. I dread to think the current ipstream churn but current speculation puts it a lot higher than 30%.

Given the churn and the fact that deep-pocketed players such as O2 and Orange are still seriously sub-scale, I can’t see Broadband margins increasing for the foreseeable future…

<< Home