Voda UK: Gaming the Market

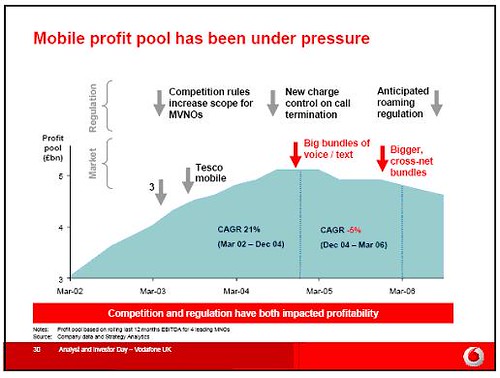

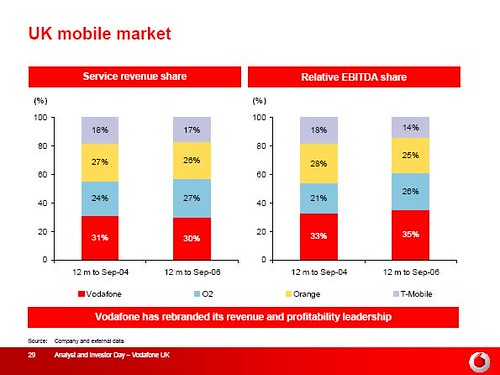

There can be no doubt that overall profitability in the UK Market has been steadily declining, probably since the 3rd March 2003. Voda themselves assign the turning point to around Dec-04, but this ignores the losses at H3G UK and the amortisation of the 3G licences. This seemed to be the focus of the City on Friday and resulted in a sharp drop in Voda share price with apparent surprise at the drop in EBITDA in the UK which has been particularly severe in 2H06/07.

The more interesting part to me was that Voda UK sent four massive signals to the market which could in the short run lead to stability in margins and in the medium term a return to slight margin growth in the UK for the whole industry. Some of mathematics behind Game Theory can be fairly tricky, but fortunately the concepts are pretty easy to understand. This means it is quite easy explain the signals covering pricing, consolidation, spectrum and the value chain.

In other words, if o2 or orange cut their prices, voda will respond immediately. In other words there is very little incentive for o2 or orange to cut their prices, because they know any gain will be extremely short term, not lead to any sustainable advantage and most importantly hurt them.

It is noticeable that both subscale operators, T-Mobile and H3G UK, are out of the “reference price” equation and their reaction will be extremely important. H3G UK seems to be currently out of the market and seem to be desperately focused on the drive to minimize losses – an aggressive market position will do nothing to help this strategy. T-Mobile were extremely aggressive last year with pricing in the Flext contract tariff and it will be interesting to see if they now continue with their rumoured equally aggressive family plan tariff after Easter.

It is important to categorically state that I do not think this is collusive behaviour as exhibited by some extremely naughty companies in some oligopolistic markets – it is more akin to a Nash “non-cooperative equilibria” situation. This is a very important point for future public policy, but is normally lost of regulators driven by politics rather than economics.

OFCOM has also done its bit to bring stability to the market with last week’s termination rate announcement. The fact that OFCOM has introduced symmetry in prices between 900MHZ (voda and o2) and 1800MHz (orange and t-mobile) operators mean there is even less incentive for orange and t-mobile to cut other tariffs in the short run. The huge pain inflicted on H3G UK with massive termination cuts is catastrophic for their business strategy of huge cross-net bundles. I expect either a revamping of bundles, a huge legal fight with OFCOM or, most probably, selling up and exiting the market.

Arun Sarin was explicit that he wanted consolidation, but he preferred someone else to buy even mentioning the potential purchaser - t-mobile in the UK. He even threw in a bonus ball saying that Wind should buy H3 Italia. This is extremely important because Voda is more or less saying to t-mobile that they will not force the price up in an auction situation. It is also well known that the new CEO of t-mobile has said that he would consider purchases in Europe to consolidate the market.

The joke question of the day was from the analyst who said “Given that H3G UK is currently out of the market, what is point of buying them?” I’m sure from the look on Andy Halford’s face that he thought the question was a trick one and therefore very quickly threw the potential hospital pass to Vittorio Colao. It should be obvious that a profit pool split up between four players is far more lucrative than a profit pool split up between five players. Also, and given the historical progression of the UK market, there is a lot of value in having one less potential schizophrenic player in the market. It also helps that there is one less buyer for government auctions of spectrum and driving up distribution costs.

Arun Sarin was extremely explicit is stating that there would be no repeat of the 3G auctions and that Voda has plenty of spectrum currently available. Back in 2000, voda exhibited much more testosterone fuelled behaviour than any other operator. I am reading this as Voda stating that they will quite happily pull out of auctions rather than overpaying. This is bad news for the UK Government Treasury as they are desperate for the cash, but great news for the mobile industry and Voda shareholders.

I also suspect that OFCOM will need to be extremely careful in the auction design, because they could be horrified at some of the outcomes. For instance, in the MobileTV space, the mobile operators might not even participate and leave someone else to build and run the service akin the NationalGrid Wireless and Arqiva roles for the DTT and DAB industry.

The only good news for OFCOM is that spectrum is the oxygen of the mobile industry and if the mobile internet takes off this year with the forthcoming flat rate pricing models in the consumer market then the operators will need plenty more spectrum – in fact the more the merrier. Despite Arun Sarin claiming he has plenty of spectrum, I think he might be more than a little shocked how quickly the 2000 spectrum gets eaten, if the youth start uploading photo’s and video’s in volume to MySpace.

As much as the retailers claim they are efficient distributors, Voda want commissions reduced further. Voda led the way in the consumer segment by the exclusive deal with Phones4U, but it looks like the situation could get worse for the retailers. This will not matter if the reduction in commissions drives out the cashback and free gift deals which I believe fundamentally undermine the value of mobile in the eyes of consumers. Again, game theory more or less guarantees that once one operator breaks the destructive downward spiral of increased commissions and proves to the market that the strategy is not affecting net sales, everyone else will follow - Game Theory can easily be used to explain the Sheep behaviour typically exhibited by network operators throughout the world. I fear that the retailers and wholesalers will be caught in a huge spiral of reduced commissions over the next few years until they arrive at a sustainable level. Add to this that Voda believe that there is going to be a contracting market in Gross Adds and the future doesn’t look rosy for retailers and distributors.

Voda UK is also tinkering with its distribution channels with four initiatives: wholesale, corporates, SMEs and consumer.

The revelation that Voda only has an 8% market share of the £1bn pa wholesale market means to me that BT is roughly paying over £80m a year for its MVNO fees. Personally, I was quite surprised by Vodas estimate of the size of this market and therefore think this must include the roaming revenues paid over by H3G UK to Orange and the payments from Tesco to o2, as well as the big T-Mobile deals with Virgin Media and Carphone. The deal with ASDA should be seen in this context and although has generated lots of noise in the press, I wouldn’t be surprised if it fizzles out in a couple of years – the comparision for me is with Sainsburys which ending up giving its mobile assets away to Carphone and exiting the services game to focus on prepaid handset sales.

In the Corporate arena, I am fascinated by the move into ICT side of the market with a couple of small recent acquisitions. This could create huge long term barriers to churn at these companies and I think could protect the Voda 54% share in the Corporate sector and the 70% share of the Government sector. It will be a long hard route, but is an interesting addition to sales capabilities.

I am more apathetic about the SME deal with PCWorld to sell Laptop Access and configure it in store. Again, it is one of those deals that generates plenty of publicity, but I doubt will seriously increase Voda’s 40% share of the SME market and 30% of the SoHo market.

The focus for 2007 in the consumer segment is the growth of online sales makes a lot of sense and offers a lot of potential especially at the value end of the consumer business which is incredibly sensitive to levels of third party commissions. Again, this is extremely bad news for the online retailers, because the Voda online advertising budget will dwarf the rest and there is a potential for Voda to crowd out the market. In fact, I’d go so far as to say if the network operators get their online channel sorted, it could signal the end for independent online retailers and lots of new revenues for the online comparator sites such as uSwitch.

Personally, I sense that appetite for fighting amongst the operators is drawing to a conclusion – especially in the core voice and texting market. I also sense a big appetite for cost reduction across all the operators and this is great news for shareholders, but terrible news for suppliers, especially the UK government – chief supplier of spectrum.

Of course, peace will not completely break out – after all that will run the risk of a Competition Commission Referral. Instead, I see the battle ground moving to the mobile internet and each of the operators chasing the growth in this revenue pot. I think if this happens it will actually be great news for the industry overall.

So, I am quite optimistic about the future for the UK Networks for the first time for a couple of years: margins could stabilize over the next six months and from stabilization it is not hard for a positive virtuous circle to start developing with year on year gradual margin improvements, especially if the macroeconomic environment remains benign. However, it will only take one or two irrational acts for open warfare to break out yet again, but overall things are looking up.

The more interesting part to me was that Voda UK sent four massive signals to the market which could in the short run lead to stability in margins and in the medium term a return to slight margin growth in the UK for the whole industry. Some of mathematics behind Game Theory can be fairly tricky, but fortunately the concepts are pretty easy to understand. This means it is quite easy explain the signals covering pricing, consolidation, spectrum and the value chain.

Pricing

Voda announced the old days of not responding to competitor price cuts and staying out of the market to improve year end EBITDA figures are over. Even more interesting is that despite Voda being #4 in terms of customer satisfaction and #3 in brand satisfaction in the consumer market, Voda would continue to charge a small single digit premium in pricing to their “reference competitors” which happen to be o2 and orange. The premium had risen to 25% in Mar ’06 in a bid to maintain margins.In other words, if o2 or orange cut their prices, voda will respond immediately. In other words there is very little incentive for o2 or orange to cut their prices, because they know any gain will be extremely short term, not lead to any sustainable advantage and most importantly hurt them.

It is noticeable that both subscale operators, T-Mobile and H3G UK, are out of the “reference price” equation and their reaction will be extremely important. H3G UK seems to be currently out of the market and seem to be desperately focused on the drive to minimize losses – an aggressive market position will do nothing to help this strategy. T-Mobile were extremely aggressive last year with pricing in the Flext contract tariff and it will be interesting to see if they now continue with their rumoured equally aggressive family plan tariff after Easter.

It is important to categorically state that I do not think this is collusive behaviour as exhibited by some extremely naughty companies in some oligopolistic markets – it is more akin to a Nash “non-cooperative equilibria” situation. This is a very important point for future public policy, but is normally lost of regulators driven by politics rather than economics.

OFCOM has also done its bit to bring stability to the market with last week’s termination rate announcement. The fact that OFCOM has introduced symmetry in prices between 900MHZ (voda and o2) and 1800MHz (orange and t-mobile) operators mean there is even less incentive for orange and t-mobile to cut other tariffs in the short run. The huge pain inflicted on H3G UK with massive termination cuts is catastrophic for their business strategy of huge cross-net bundles. I expect either a revamping of bundles, a huge legal fight with OFCOM or, most probably, selling up and exiting the market.

Consolidation

It is pretty obvious that the purchase of H3G UK by one of the four operators could push the market further towards equilibrium. This would be especially true if t-mobile bought H3G UK. T-Mobile is the smallest of the four network players and therefore would benefit most from the “network” effect of loading additional traffic and customers onto their network and would also have the lowest physical network overlap compared with the other three operators.Arun Sarin was explicit that he wanted consolidation, but he preferred someone else to buy even mentioning the potential purchaser - t-mobile in the UK. He even threw in a bonus ball saying that Wind should buy H3 Italia. This is extremely important because Voda is more or less saying to t-mobile that they will not force the price up in an auction situation. It is also well known that the new CEO of t-mobile has said that he would consider purchases in Europe to consolidate the market.

The joke question of the day was from the analyst who said “Given that H3G UK is currently out of the market, what is point of buying them?” I’m sure from the look on Andy Halford’s face that he thought the question was a trick one and therefore very quickly threw the potential hospital pass to Vittorio Colao. It should be obvious that a profit pool split up between four players is far more lucrative than a profit pool split up between five players. Also, and given the historical progression of the UK market, there is a lot of value in having one less potential schizophrenic player in the market. It also helps that there is one less buyer for government auctions of spectrum and driving up distribution costs.

Spectrum

Potentially there are three big auctions looming over the next couple of years:- 190MHz (2500-2690MHz) which is perfect spectrum for WiMax and potentially for LTE if it ever exits halls of the standards bodies.

- 40MHz (1452MHz-1492MHz) which is near perfect for MobileTV

- The Digital Dividend Spectrum (470MHz-854MHz) which is top notch high value spectrum for loads of applications.

Arun Sarin was extremely explicit is stating that there would be no repeat of the 3G auctions and that Voda has plenty of spectrum currently available. Back in 2000, voda exhibited much more testosterone fuelled behaviour than any other operator. I am reading this as Voda stating that they will quite happily pull out of auctions rather than overpaying. This is bad news for the UK Government Treasury as they are desperate for the cash, but great news for the mobile industry and Voda shareholders.

I also suspect that OFCOM will need to be extremely careful in the auction design, because they could be horrified at some of the outcomes. For instance, in the MobileTV space, the mobile operators might not even participate and leave someone else to build and run the service akin the NationalGrid Wireless and Arqiva roles for the DTT and DAB industry.

The only good news for OFCOM is that spectrum is the oxygen of the mobile industry and if the mobile internet takes off this year with the forthcoming flat rate pricing models in the consumer market then the operators will need plenty more spectrum – in fact the more the merrier. Despite Arun Sarin claiming he has plenty of spectrum, I think he might be more than a little shocked how quickly the 2000 spectrum gets eaten, if the youth start uploading photo’s and video’s in volume to MySpace.

Value Chain

Vittorio Colao was also quite explicit in mentioning that he didn’t feel the reduction in profitability in the mobile operator space was being shared by other participants in the mobile value chain. This is bad news for all Vodafone UK suppliers; but personally I think the comment was aimed at the mobile distributors and retailers.As much as the retailers claim they are efficient distributors, Voda want commissions reduced further. Voda led the way in the consumer segment by the exclusive deal with Phones4U, but it looks like the situation could get worse for the retailers. This will not matter if the reduction in commissions drives out the cashback and free gift deals which I believe fundamentally undermine the value of mobile in the eyes of consumers. Again, game theory more or less guarantees that once one operator breaks the destructive downward spiral of increased commissions and proves to the market that the strategy is not affecting net sales, everyone else will follow - Game Theory can easily be used to explain the Sheep behaviour typically exhibited by network operators throughout the world. I fear that the retailers and wholesalers will be caught in a huge spiral of reduced commissions over the next few years until they arrive at a sustainable level. Add to this that Voda believe that there is going to be a contracting market in Gross Adds and the future doesn’t look rosy for retailers and distributors.

Voda UK is also tinkering with its distribution channels with four initiatives: wholesale, corporates, SMEs and consumer.

The revelation that Voda only has an 8% market share of the £1bn pa wholesale market means to me that BT is roughly paying over £80m a year for its MVNO fees. Personally, I was quite surprised by Vodas estimate of the size of this market and therefore think this must include the roaming revenues paid over by H3G UK to Orange and the payments from Tesco to o2, as well as the big T-Mobile deals with Virgin Media and Carphone. The deal with ASDA should be seen in this context and although has generated lots of noise in the press, I wouldn’t be surprised if it fizzles out in a couple of years – the comparision for me is with Sainsburys which ending up giving its mobile assets away to Carphone and exiting the services game to focus on prepaid handset sales.

In the Corporate arena, I am fascinated by the move into ICT side of the market with a couple of small recent acquisitions. This could create huge long term barriers to churn at these companies and I think could protect the Voda 54% share in the Corporate sector and the 70% share of the Government sector. It will be a long hard route, but is an interesting addition to sales capabilities.

I am more apathetic about the SME deal with PCWorld to sell Laptop Access and configure it in store. Again, it is one of those deals that generates plenty of publicity, but I doubt will seriously increase Voda’s 40% share of the SME market and 30% of the SoHo market.

The focus for 2007 in the consumer segment is the growth of online sales makes a lot of sense and offers a lot of potential especially at the value end of the consumer business which is incredibly sensitive to levels of third party commissions. Again, this is extremely bad news for the online retailers, because the Voda online advertising budget will dwarf the rest and there is a potential for Voda to crowd out the market. In fact, I’d go so far as to say if the network operators get their online channel sorted, it could signal the end for independent online retailers and lots of new revenues for the online comparator sites such as uSwitch.

Conclusion

The Mobile Industry is a perfect industry for the studying the real life applicability of Game Theory to an Oligopolistic Market. This is a fact but what is more uncertain and of far more value is whether the UK market has reached the bottom of the cycle.Personally, I sense that appetite for fighting amongst the operators is drawing to a conclusion – especially in the core voice and texting market. I also sense a big appetite for cost reduction across all the operators and this is great news for shareholders, but terrible news for suppliers, especially the UK government – chief supplier of spectrum.

Of course, peace will not completely break out – after all that will run the risk of a Competition Commission Referral. Instead, I see the battle ground moving to the mobile internet and each of the operators chasing the growth in this revenue pot. I think if this happens it will actually be great news for the industry overall.

So, I am quite optimistic about the future for the UK Networks for the first time for a couple of years: margins could stabilize over the next six months and from stabilization it is not hard for a positive virtuous circle to start developing with year on year gradual margin improvements, especially if the macroeconomic environment remains benign. However, it will only take one or two irrational acts for open warfare to break out yet again, but overall things are looking up.

<< Home