Telenor: 1 out of 4 Turkeys come home to Roost

Telenor shocked the markets post-Oslo close tonight by announcing that because of the fight with Alfa/Altimo they have decided to deconsolidate the Ukrainian operations.

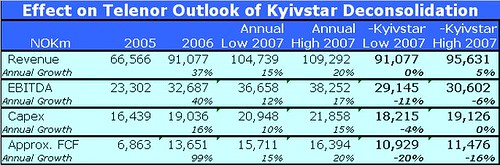

The following chart show the revised 2007 Telenor outlook given the new data:

The deconsolidation of Kyivstar shows a drop of EBITDA even in the best scenario and approx. Cashflow shows an even more dramatic drop. Anyone using simple EBITDA/EV or FCF yield calculations will show a significant drop in overall valuation of the Telenor Empire and I expect this to be reflected with at least a 10% drop in the share price in morning.

Of course, all of this is just financial trickery – Telenor still own 56.5% of Kyivstar – and if people were valuing Telenor on a “sum of the parts” basis and applying normal political risk factors to each country then nothing will have changed. We will see in the morning, but to give a hint TELN ADRs on the NASDAQ dropped by 6% after the announcement in Oslo.

The big question this all brings to my mind is the credibility of the management. Only on the 15th Feb in Barcelona the CEO and CFO stood up and said the Alfa injunction in the Ukraine was more of a “formal” thing and they expected it to go away and doesn’t change any element of control. Well, it seems to me that either the auditors or the board non-executives disagreed with this statement. In the conference call tonight, the CFO (the CEO didn’t grace the call with his presence) stated that Telenor would only start consolidating Kyivstar again when Alfa started attending board meetings, which Alfa haven’t attended for the last two years and therefore two years of board meeting have never had a quorum - we are probably at an impasse of indefinite length. Of course, the simple solution is for Telenor to cash in its chips and sell out, especially given that the Ukraine market is probably about to go ex-growth. However, there is no guarantee that Alfa will pay a reasonable price.

There is also the spill over of the fight with Alfa affecting the Russian/CIS operator, Vimpelcom. Alfa have recently increased their stake to 42.4% and the CFO brushed aside the question as to whether this would allow Alfa to nominate another director to the company. Although, Telenor make much of the arbitration proceedings ongoing in New York, all I can see is that Alfa keeping beating them in every round of the fight. If Telenor aren’t careful, the arbitrator may determines Telenor's health will be endangered by more blows and therefore stops the fight and awards the winner’s spoils to Alfa.

Telenor also has problems in Thailand, Malaysia and Bangladesh. I suspect if just one more Turkey comes home to Roost this year, probably the Telenor senior executives will be looking for a new farm to manage.

The following chart show the revised 2007 Telenor outlook given the new data:

The deconsolidation of Kyivstar shows a drop of EBITDA even in the best scenario and approx. Cashflow shows an even more dramatic drop. Anyone using simple EBITDA/EV or FCF yield calculations will show a significant drop in overall valuation of the Telenor Empire and I expect this to be reflected with at least a 10% drop in the share price in morning.

Of course, all of this is just financial trickery – Telenor still own 56.5% of Kyivstar – and if people were valuing Telenor on a “sum of the parts” basis and applying normal political risk factors to each country then nothing will have changed. We will see in the morning, but to give a hint TELN ADRs on the NASDAQ dropped by 6% after the announcement in Oslo.

The big question this all brings to my mind is the credibility of the management. Only on the 15th Feb in Barcelona the CEO and CFO stood up and said the Alfa injunction in the Ukraine was more of a “formal” thing and they expected it to go away and doesn’t change any element of control. Well, it seems to me that either the auditors or the board non-executives disagreed with this statement. In the conference call tonight, the CFO (the CEO didn’t grace the call with his presence) stated that Telenor would only start consolidating Kyivstar again when Alfa started attending board meetings, which Alfa haven’t attended for the last two years and therefore two years of board meeting have never had a quorum - we are probably at an impasse of indefinite length. Of course, the simple solution is for Telenor to cash in its chips and sell out, especially given that the Ukraine market is probably about to go ex-growth. However, there is no guarantee that Alfa will pay a reasonable price.

There is also the spill over of the fight with Alfa affecting the Russian/CIS operator, Vimpelcom. Alfa have recently increased their stake to 42.4% and the CFO brushed aside the question as to whether this would allow Alfa to nominate another director to the company. Although, Telenor make much of the arbitration proceedings ongoing in New York, all I can see is that Alfa keeping beating them in every round of the fight. If Telenor aren’t careful, the arbitrator may determines Telenor's health will be endangered by more blows and therefore stops the fight and awards the winner’s spoils to Alfa.

Telenor also has problems in Thailand, Malaysia and Bangladesh. I suspect if just one more Turkey comes home to Roost this year, probably the Telenor senior executives will be looking for a new farm to manage.

<< Home