Customer Numbers must be the silliest way of measuring market share, especially when you are a budget operator (ie most EuroMVNOs) and chasing customers who are attracted by value who are not necessarily the type that MNOs chase after.

An analysis of the Danish markets illustrates my point perfectly. I am using data from the Danish regulator covering the second half of 2005. I’ve chosen Denmark because they are the home of Telmore, supposedly the innovator of the low-cost SIM-free model and therefore the market is much more mature than in other Western Economies and also because the Danish regulator releases the best statistics. It would be impossible to perform the same analysis in the UK, where the ultra-inefficient regulator, OFCOM, does not publish data on the 5th Operator let alone MVNOs.

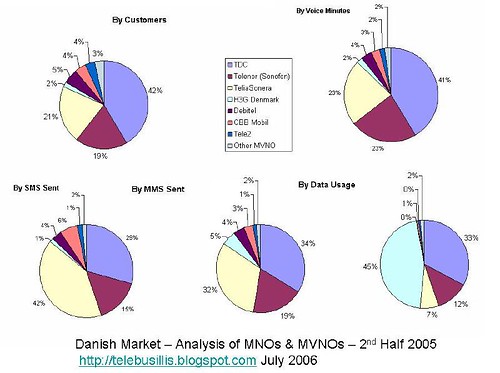

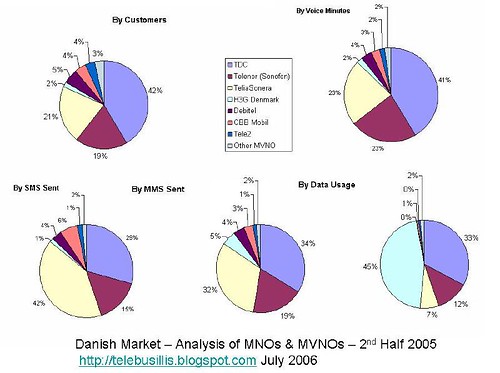

In the Danish Market, there are 2 2G Operators (Telenor, TeliaSonera), 1 Start-Up 3G Operator (H3G Denmark), 1 incumbent PTT, TDC who operators both a 2G and 3G network and 17 MVNOs (!!!) , that figure does not include the two sub-brands of TDC (Song and Telmore) and which used to operate independently but have now been purchased by the struggling national carrier TDC (comparisons with KPN are very welcome). CBB Mobil which although shown separately on the graphs is also owned by another MNO, Telenor aka Sonofon.

MVNOs account for 12.09% of customers, but only 7.88% of voice traffic, 6.58% of SMS traffic, 6.89% of MMS traffic and a meager 2.19% of data traffic. So in terms of traffic, the average MVNO uses the phone far less. What is even more interesting about the analysis is that really there are only 2 MVNOs with anywhere a decent level of traffic (debitel and Tele2) and debitel’s market share has actually declined in the last 6 months. I hardly think the big MNOs are worried with that level of market share and even if they are the MVNOs seem to put themselves up for sale at the first opportunity.

I remember almost to the day when the term MVNO was trust upon the world and I’m sure Tom Alexander or someone in his marketing team at Virgin Mobile invented the term. After all, how would you attract financing if you were called a mere reseller?

Unfortunately, I’m old enough to remember the day when MVNOs were flourishing in the UK market: Vodafone had 40 named in its’ 1990 annual report. Back in the day they were called “Service Providers” and the reason they were flourishing was because Vodafone and Cellnet were not permitted to sell direct to Joe Public and performed solely a wholesale role alone. This all changed when the Orange and One2One PCS licenses were issued. Vodafone and Cellnet immediately went on a buying spree hovering up their main Service Providers. What goes around comes around…

Speaking of coming around - Millicom was one of the 40 Service Providers ;-)

<< Home