A good week for Virgin Media

Virgin Media have updated its guidance for Q2 saying that TV subscribers would be flat. Although the cost of retentions deals hasn’t been revealed, I think this is good news for the beleaguered Virgin Media shareholders. Usually, it is far more expensive to acquire a subscriber than hold onto one.

Even better news is that it seems as if Virgin Media plan to invest in content differentiation. I was totally amazed when I looked at the BARB viewing figures that Sky Sports News had better figures than Sky News, so it is hardly surprising that Virgin Media are planning on launching a Sports News channel.

It is also interesting to see that Virgin Media are considering a tie-up with Warner for first dibs on their TV output. This represents a growing trend with the big US TV Networks: ITV have a deal with NBC; C4 with ABC; Sky’s has an obvious association with Fox; and Five have a big deal with the #1 CBS show, CSI. It doesn’t take a mathematical genius to calculate that the big five US networks can find a partner with the major five UK networks – freezing BBC out in the cold. Personally, I don’t think this would be a bad thing for UK TV effectively forcing BBC to do joint productions with the cable TV innovators such as HBO and the Discovery Channel.

On PayTV it looks as if the biggest differentiators (excluding price) are Virgin Media with its on-demand service and Sky with coverage and interactive TV. Virgin Media is obviously investing a lot in trying to address the brand and content advantage of Sky.

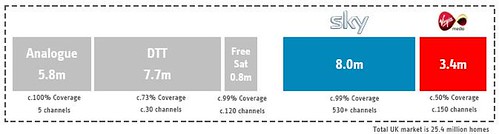

Sky presented a high level view of the UK TV market in a recent Merrill Lynch Media Conference and it shows to me that there is plenty of growth available for both Sky and Virgin Media – payTV penetration is still at less than 50% of UK homes.

Even with only 20% of the current payTV refuseniks being converted in the run up to Digital Switch Over, it would only represent a 55% payTV penetration of UK homes. This additional 20% would yield 2.4m homes or 100k new payTV subscribers per quarter for the next six years for the payTV industry. In a six year timeframe it is very difficult to believe that Virgin Media won’t get its act together and start adding new TV subscribers.

Virgin Media are still forecasting a net loss of overall customers in the Q2 quarter and this is more a reflection on the weaknesses with telephony only customers than either broadband or TV. There is a telephony tariff refresh promised at the end of the summer which will probably finally halt the decline and will probably see Virgin Media in Q4 move to overall net customer additions.

Even better news is that it seems as if Virgin Media plan to invest in content differentiation. I was totally amazed when I looked at the BARB viewing figures that Sky Sports News had better figures than Sky News, so it is hardly surprising that Virgin Media are planning on launching a Sports News channel.

It is also interesting to see that Virgin Media are considering a tie-up with Warner for first dibs on their TV output. This represents a growing trend with the big US TV Networks: ITV have a deal with NBC; C4 with ABC; Sky’s has an obvious association with Fox; and Five have a big deal with the #1 CBS show, CSI. It doesn’t take a mathematical genius to calculate that the big five US networks can find a partner with the major five UK networks – freezing BBC out in the cold. Personally, I don’t think this would be a bad thing for UK TV effectively forcing BBC to do joint productions with the cable TV innovators such as HBO and the Discovery Channel.

On PayTV it looks as if the biggest differentiators (excluding price) are Virgin Media with its on-demand service and Sky with coverage and interactive TV. Virgin Media is obviously investing a lot in trying to address the brand and content advantage of Sky.

Sky presented a high level view of the UK TV market in a recent Merrill Lynch Media Conference and it shows to me that there is plenty of growth available for both Sky and Virgin Media – payTV penetration is still at less than 50% of UK homes.

Even with only 20% of the current payTV refuseniks being converted in the run up to Digital Switch Over, it would only represent a 55% payTV penetration of UK homes. This additional 20% would yield 2.4m homes or 100k new payTV subscribers per quarter for the next six years for the payTV industry. In a six year timeframe it is very difficult to believe that Virgin Media won’t get its act together and start adding new TV subscribers.

Virgin Media are still forecasting a net loss of overall customers in the Q2 quarter and this is more a reflection on the weaknesses with telephony only customers than either broadband or TV. There is a telephony tariff refresh promised at the end of the summer which will probably finally halt the decline and will probably see Virgin Media in Q4 move to overall net customer additions.

<< Home