US 4Q2006 Battle of the Titans

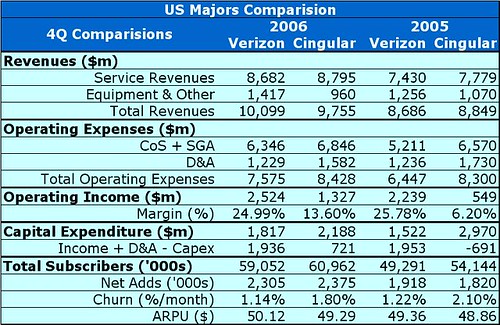

The underlying story of the last year is one of Verizon Wireless (VZW) catching Cingular in terms of bulk and Cingular catching VZW in terms of efficiency and profitability.

In twelve months, Cingular has added approx. US$1.4bn in cash generation and US$778m in Operating Profit. This is a fantastic achievement and shows that the merger benefits are being achieved. Cingular will struggle to catch up with the VZW margins before the Analogue and TDMA networks are turned off in 1Q2008. I also expect the rebrand of Cingular to "at&t mobility" will be expensive and do nothing in the short term to help with churn.

Cingular has a lot of work to do to reduce churn to VZW levels: a 0.66% monthly churn rate differentiation may not seem like much, but it equates to 1,272k gross customers that Cingular have to recruit each quarter just to keep the status quo with VZW. VZW is very smart in now reporting three figures for churn: retail postpaid, retail prepaid and wholesale. I suspect Cingular will have to repeat this categorization in 2007.

Meanwhile, VZW have not progressed in the year with the Operating Margin with it remaining in the 25% range. In the 4Q conference call, Denny Strigl, said that the margins would remain steady throughout 2007. However, maintaining the margin has resulted in US$300m (12.7%) increase in absolute profits which is also a great number. It certainly puts the stagnant profits in many markets of the 44.4% minority partner, Vodafone, in perspective and shows why Voda still loves VZW as an asset.

The source of this growth in the bottom line for VZW was the Revenue growth and VZW now advertise themselves as the #1 USA wireless network in terms of revenues. Verizon is closing fast on Cingular on the all important Service Revenue metric and will probably overtake them in 1Q2007. This is because VZW has a higher average spend per customer (ARPU) which is partially a result of VZW having a higher number of the higher spending retail postpaid subscribers on its network.

Personally, I think Cingular and Sprint are falling into a “European” style trap of counting the wholesale customers as customers. This is because as the wireless market inevitably saturates, Wall St will start to focus on ARPU and Churn Indicators. Whilst, wholesale customers are typically more profitable percentage-wise than retail customers, they bring down the key ARPU and Churn metrics. Large successful European Operators such as Vodafone and O2 have started not to count wholesale customers and therefore inflate the overall ARPU figures and lower the churn figures. This trend is not a problem for VZW as it has the lowest percentage of wholesale customers on its base.

VZW is now advertising itself as the #1 network in terms of Retail Customers. I expect that by the end of 2007 given 2006 growth that VZW will actually overtake Cingular in terms of overall customers. Although a successful launch of the iPhone could help Cingular in overall numbers.

I was a little disappointed with the Verizon comments on the conference call about the iPhone. For one, it runs the risk of starting a slanging match with the main competitor. A little humility and quiet confidence with - "We are happy with our position and will compete when the time is right" - would have been suffice for me. However, there was clearly pressure on Denny Strigl to answer - why did Apple not pick VZW?

I thought the answer about the distribution network was interesting because I remember reading a while back about Wal*Mart putting huge pressure on the Movie studios for equal prices for DVDs and digital downloads. I believe they also had a fight with Disney which Jobs has a large shareholding in. Wal*Mart didn't want the same thing happening in DVDs as is happening with iTunes and CDs. I think given that Wal*Mart will predominately sell prepaid that this comment was purely VZW sucking up to Wal*Mart and creating trouble for Cingular in the process with one of the key US prepaid distributors.

The other answer was the high level of on-going commissions that Apple requested. I also think was intended to apply pressure on Cingular within the analyst community. Basically, VZW was saying the deal isn't worthwhile and Apple gets to eat too much of the cake. I'm not sure how Cingular can answer these allegations without revealing the contract terms. One thing Cingular have in their favour is that in early '08, the analogue and TDMA networks will be turned off, the rebrand will be over and therefore Cingular margins will shoot up naturally. Wall St will be none the wiser and the exclusive deal will seem justified to the financial community. This is of course assuming that the details of the deal don’t leak out beforehand which will be what VZW will be hoping for if the terms are indeed onerous.

The other point is that the answer looked canned and ready to go and missed the big chance to plug CDMA innovation and technological strength versus W-CDMA. The question was actually about VZW's poor handset range - which I don't think is true. In terms of functionality, I think VZW has always led Cingular. I also think with the imminent launch of broadcast mobileTV and the poor data speeds on the iPhone, Denny Strigl missed a trick or two.

Given that the iPhone is functionally inferior to handsets already on the market, the key to success is the power of the Apple brand and the fact that many followers of the Apple Cult will undoubtedly buy the handset in droves like lemmings on a cliff. My big question is who are these lemmings currently signed up with? If they are “cellphone poseurs” they may already be users of trendier Cingular GSM handsets and therefore the iPhone may just be an expensive exercise in cannabilisation. I think the T-Mobile Sidekick crowd will also be sorely tempted to jump ship to the Apple brand.

The probability of Samsung and LG not rushing out a CDMA handset with a touchscreen and motion detector before the launch of the iPhone is next to zero.

I can't believe in the UK that voda, orange or t-mobile will launch the iPhone product and destroy their music strategy in the process. I am guessing that the UK launch network will be the "all fur coat and no knickers" operator - o2. We will then really see the power of the Apple brand and Mr Jobs may not like the answer. I can guarantee that the US$599 price point won't survive for a nanosecond in the UK.

<< Home