OFCOM: BBC On Demand Proposals

OFCOM have released another monster (and interesting) report which is the Market Impact Assessment on the proposed BBC On Demand services. It is too early for me to have digested the whole 168 pages, but there are three points that immediately spring to my mind from an initial glance at the report.

This picture will be so scary for the traditional advertising based networks: basically they need to develop alternative sources of revenue – fast. It is especially scary for Channel 4 and five, who buy or commission the majority of their content and therefore will probably, not own many non-broadcast rights.

It also shows the relative importance of PVRs compared to VOD which I totally agree with. The lack of subsidized PVR on the Freeview platform shows the underlying fault in the distribution compared to cable and satellite.

DVD viewing are expected to decline, which I also wholeheartedly agree with and I consider the HD-DVD wars will come to pass as the biggest waste of money since World War I.

I believe that the four long term underlying trends facing the networks are:

The above chart neatly sums up the problems for the typical Free to Air broadcasters:

I also believe that the approach of BT, Channel 4 and five in their VOD services is also fatally flawed (via small charges). The bundle will beat it every time and this is something that Sky Anytime offers.

On the bundle, I also expect Sky to start to take aim at the DVD Rental and Sale market quite soon. I can imagine them offering for instance at £10/month subscriptions – 5 DVD Rentals per month either the new releases via satellite broadcast or for the long tail via Sky Broadband to your PVR to watch once at your convenience. No need to visit Blockbusters ever again. Also you offer the capability to buy the DVD once watched and all the DVD extras are downloaded. The experiments will probably start this year once the PVR is connected to Sky Broadband. It might start with just one Hollywood studio, for instance, Fox.

Basically, the channels face being squeezed by both the external right holder and the subscription channel retailers. For students of Media Industry History, it is of great note how John Malone at TCI managed to accumulate great capital wealth, by effectively taking minority equity positions in several channels.

I believe the BBC management is being delusional in believing that DRM will work in short, medium or long term. 7-day catch-up will be irrelevant because EVERYTHING will be available. It will not even take the DRM to be cracked for everything to be copied. After all free to air TV is not encrypted and can be recorded to PVRs and then uploaded to the internet.

In fact for the BBC this is not as big a problem as might be apparent. The whole design of the iMP is such that the end-user pays for the distribution costs. Does it really matter for the BBC if an user gets the content via a BBC p2p network or via some other p2p network? As long as the BBC symbol appears in the top-right corner and people realize that this is something that was paid for by the licence fee. Effectively the BBC is another subscription network who is constrained from moving into being an ISP as ntl and Sky have done.

DRM is a much, much bigger problem for non-subscription channels such as ITV, Channel 4 and five who rely on advertising revenues.

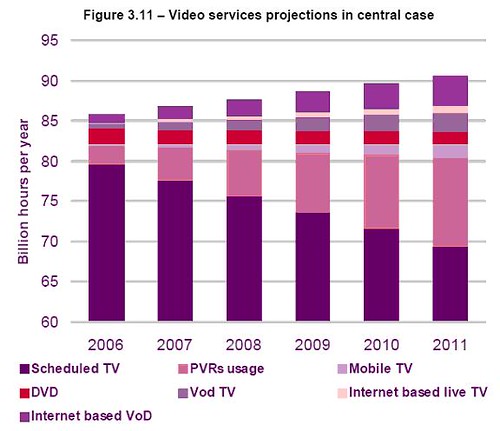

OFCOM estimates of Video Services Consumption

This picture will be so scary for the traditional advertising based networks: basically they need to develop alternative sources of revenue – fast. It is especially scary for Channel 4 and five, who buy or commission the majority of their content and therefore will probably, not own many non-broadcast rights.

It also shows the relative importance of PVRs compared to VOD which I totally agree with. The lack of subsidized PVR on the Freeview platform shows the underlying fault in the distribution compared to cable and satellite.

DVD viewing are expected to decline, which I also wholeheartedly agree with and I consider the HD-DVD wars will come to pass as the biggest waste of money since World War I.

I believe that the four long term underlying trends facing the networks are:

- broadcast hours declining, but remaining especially strong for event TV such as live sports and news. A larger and larger chunk of the total hours watched will be served by consumers who are just not appealing to advertisers;

- non linear viewing with PVRs will explode and will be rapidly become the preferred method of watching dramas and non-event TV;

- Video-on-demand (or downloads) will serve the long tail, especially for films and old classic series. I believe the BBC approach of 7-day catch-up will fail in the market; and

- the terminal decline of physical media (eg DVD or CD) as a means of distribution.

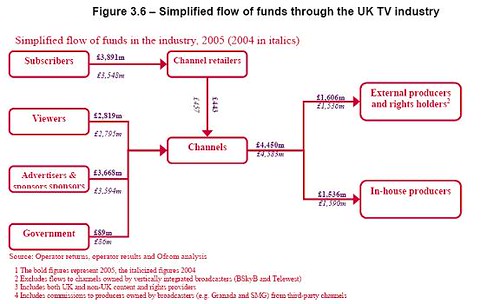

Flow of Funds

The above chart neatly sums up the problems for the typical Free to Air broadcasters:

- the fastest growing part of the industry is subscriptions (ntl + sky) which is growing at 14% per annum;

- advertising is shrinking; and

- the licence payers which is the viewers part is also growing at nowhere near the rate of subscribers.

I also believe that the approach of BT, Channel 4 and five in their VOD services is also fatally flawed (via small charges). The bundle will beat it every time and this is something that Sky Anytime offers.

On the bundle, I also expect Sky to start to take aim at the DVD Rental and Sale market quite soon. I can imagine them offering for instance at £10/month subscriptions – 5 DVD Rentals per month either the new releases via satellite broadcast or for the long tail via Sky Broadband to your PVR to watch once at your convenience. No need to visit Blockbusters ever again. Also you offer the capability to buy the DVD once watched and all the DVD extras are downloaded. The experiments will probably start this year once the PVR is connected to Sky Broadband. It might start with just one Hollywood studio, for instance, Fox.

Basically, the channels face being squeezed by both the external right holder and the subscription channel retailers. For students of Media Industry History, it is of great note how John Malone at TCI managed to accumulate great capital wealth, by effectively taking minority equity positions in several channels.

DRM

I believe the BBC management is being delusional in believing that DRM will work in short, medium or long term. 7-day catch-up will be irrelevant because EVERYTHING will be available. It will not even take the DRM to be cracked for everything to be copied. After all free to air TV is not encrypted and can be recorded to PVRs and then uploaded to the internet.

In fact for the BBC this is not as big a problem as might be apparent. The whole design of the iMP is such that the end-user pays for the distribution costs. Does it really matter for the BBC if an user gets the content via a BBC p2p network or via some other p2p network? As long as the BBC symbol appears in the top-right corner and people realize that this is something that was paid for by the licence fee. Effectively the BBC is another subscription network who is constrained from moving into being an ISP as ntl and Sky have done.

DRM is a much, much bigger problem for non-subscription channels such as ITV, Channel 4 and five who rely on advertising revenues.

<< Home