Carphone UK Sales Analysis

Before, Carphone release their vital Christmas Trading Update, I thought it would be useful to analyse the historical Carphone sales figures, especially with regard to the important of the Vodafone account. This analysis has been performed with publicly available statistics from the Carphone website.

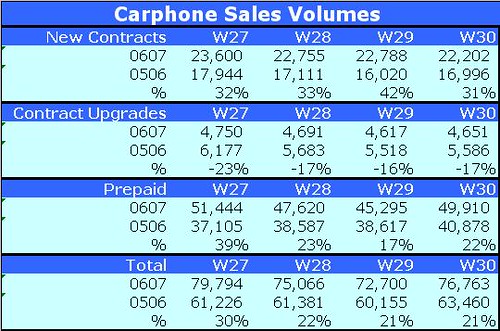

Carphone actually had a very good start to the Christmas quarter with volumes from the first four weeks showing a healthy increase on last year. However, in 0506 sales were skewed towards the final two months with only 30% of new sales and 16% of prepaid sales occurring in October.

Vodafone really was quite insignificant for Carphone for most of the 05/06 and 06/07 where it averaged only 8% of total Carphone new contract sales during the first 22 weeks of the year. However this all changed with the Vodafone tariff refresh in Sept where Vodafone balanced its post-paid tariffs with the other networks and in October when it refreshed the prepaid costs. New sales in September hit 27% of the total Carphone sales. Obviously they fell back with the announcement on Oct 12th that Phones4U was to be the not-so-exclusive partner.

This seems to tally with data at the time of the Phones4U deal saying that Vodafone was taking around 27% of the market. It does seem however that the alleged commitment of 30k/month by Phones4U would have looked quite a lot, but with the tariff refresh and the Vodafone Family deal launching in Nov - who knows? Anyway, Vodafone have always said the Phones4U deal was all about lifetime value and pure connection numbers only provide one variable in calculating customer profitability.

Another way to look at the Carphone figures is in the context of the overall post-paid Vodafone base which was around 6.5m at the end of September and with an annual churn rate of 18.8% gives a quarterly absolute churn figure of 305k. These are the new postpaid customers are required just to stand still. Normal, Carphone figures of around 15k are hardly significant and even with the tariff refresh of 35k probably reflect market share gains by Vodafone rather than an absolute increase in the Carphone distribution.

It does appear as neither Carphone nor Vodafone are really vital for each other. Carphone definitely seems to have a case when they say “Give us a competitive tariff and we can sell” – this is highlighted by the rises in Vodafone absolute volumes when consumer tariffs were made more competitive.

However, it could also be argued that network operators themselves actually encourage churn by offering better prices for new customers than for upgrades. It is a well-known dirty secret that the best upgrade price will only be given by the network operator when you ring up to cancel your service.

I definitely have some sympathy for Carphone here.

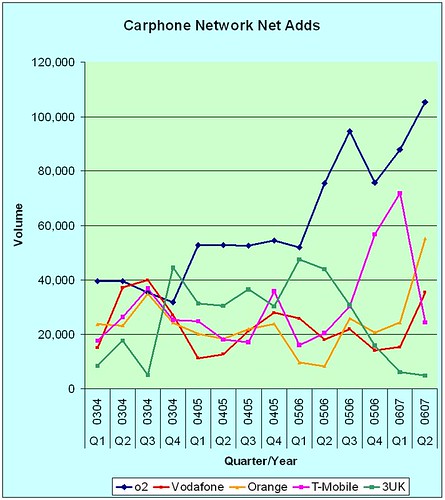

There are three things which immediately spring to mind from this chart:

Having said that volumes have started well in the first four weeks of Q3. The Vodafone volumes do not seem critical for Carphone or Vodafone themselves. Carphone has also shown in the past they can cope with one network’s volumes (3UK) dropping off quickly. Really, the critical network for Carphone is o2 and if they drop their commissions than this would cause a lot more pain than the loss of Vodafone.

The debate is all about whether Carphone can claim to be offering independent advice when effectively two networks (Vodafone and 3UK) are not being sold.

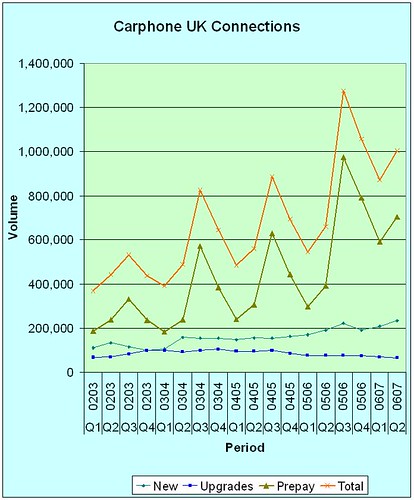

Carphone Seasonal Sales

In terms of volume, there are huge seasonal spikes in prepaid sales in the Chirstmas quarter. New Contract Sales have been steadily increasing over the years with very little Christmas spikes. Contract Upgrades have been stable despite the big increase in the UK base of contract customers.Carphone actually had a very good start to the Christmas quarter with volumes from the first four weeks showing a healthy increase on last year. However, in 0506 sales were skewed towards the final two months with only 30% of new sales and 16% of prepaid sales occurring in October.

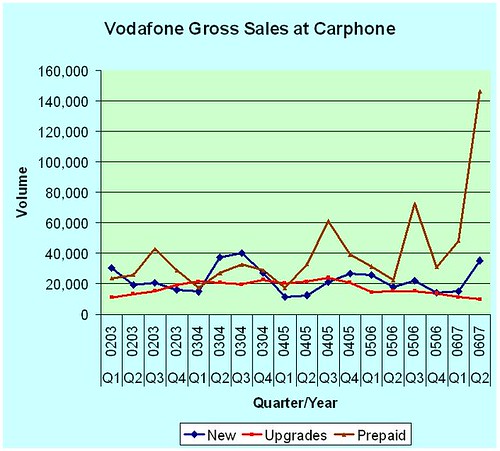

Actual Vodafone Volumes

Vodafone really was quite insignificant for Carphone for most of the 05/06 and 06/07 where it averaged only 8% of total Carphone new contract sales during the first 22 weeks of the year. However this all changed with the Vodafone tariff refresh in Sept where Vodafone balanced its post-paid tariffs with the other networks and in October when it refreshed the prepaid costs. New sales in September hit 27% of the total Carphone sales. Obviously they fell back with the announcement on Oct 12th that Phones4U was to be the not-so-exclusive partner.

This seems to tally with data at the time of the Phones4U deal saying that Vodafone was taking around 27% of the market. It does seem however that the alleged commitment of 30k/month by Phones4U would have looked quite a lot, but with the tariff refresh and the Vodafone Family deal launching in Nov - who knows? Anyway, Vodafone have always said the Phones4U deal was all about lifetime value and pure connection numbers only provide one variable in calculating customer profitability.

Another way to look at the Carphone figures is in the context of the overall post-paid Vodafone base which was around 6.5m at the end of September and with an annual churn rate of 18.8% gives a quarterly absolute churn figure of 305k. These are the new postpaid customers are required just to stand still. Normal, Carphone figures of around 15k are hardly significant and even with the tariff refresh of 35k probably reflect market share gains by Vodafone rather than an absolute increase in the Carphone distribution.

It does appear as neither Carphone nor Vodafone are really vital for each other. Carphone definitely seems to have a case when they say “Give us a competitive tariff and we can sell” – this is highlighted by the rises in Vodafone absolute volumes when consumer tariffs were made more competitive.

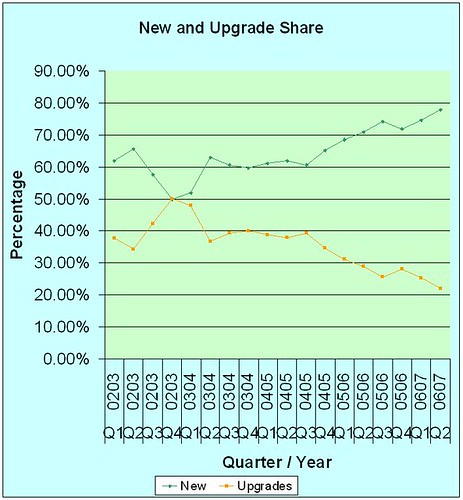

New vs Upgrade Percentages

One of the biggest complaints about Carphone (and to be fair other retailers) is that they encourage churn and a historical comparision of the absolute percentages of new contracts vs contract upgrades seem to give credence to this statement.However, it could also be argued that network operators themselves actually encourage churn by offering better prices for new customers than for upgrades. It is a well-known dirty secret that the best upgrade price will only be given by the network operator when you ring up to cancel your service.

I definitely have some sympathy for Carphone here.

Other Network Sales at Carphone

There are three things which immediately spring to mind from this chart:

- the domination of o2 in absolute numbers;

- the huge leap of sales by T-Mobile when the Flext tariff was launched and the immediate drop when commissions were infamously slashed but the tariffs remained as extremely good value; and

- the extremely poor and dropping share of 3UK.

Conclusion

Volumes are only one part of the equation: dealer commissions, handset prices and mix are even more important in determining the gross profit which really is the benchmark which Carphone should be judged.Having said that volumes have started well in the first four weeks of Q3. The Vodafone volumes do not seem critical for Carphone or Vodafone themselves. Carphone has also shown in the past they can cope with one network’s volumes (3UK) dropping off quickly. Really, the critical network for Carphone is o2 and if they drop their commissions than this would cause a lot more pain than the loss of Vodafone.

The debate is all about whether Carphone can claim to be offering independent advice when effectively two networks (Vodafone and 3UK) are not being sold.

<< Home