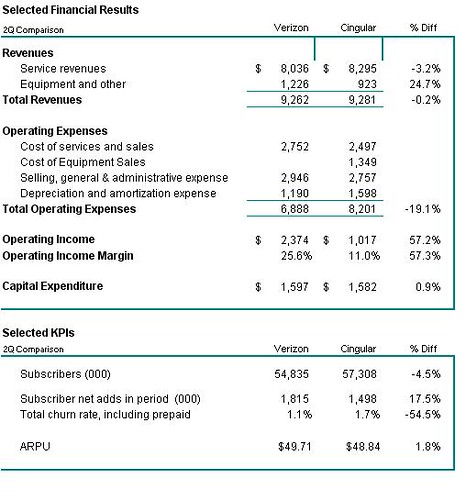

Verizon Wireless v Cingular: 2005 Q2

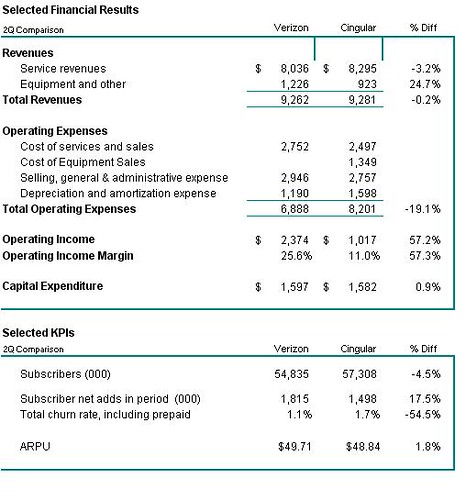

A quick comparison between the Verizon Wireless (VZW) and Cingular 2Q reports highlights the big part that cost control plays in the far better performance by VZW. The individual line items in the operating expenses do not match, but it is clear that overall VZW has the lower cost base, even on a cash basis (ie before depreciation and amortization)

VZW’s revenues are catching up fast with Cingular and VZW will in all probability overtake Cingular before the end of the year, even in terms of service revenue.

As I mentioned before Cingular are currently in the process of turning off its’ TDMA and Analogue network which are both due to be turned off in early 2008. I’m sure that this will reduce their cost base, but don’t think by enough to catch up with VZW. The Cingular marketing brains have come up with a rather unique way of forcing people to move networks – by raising the bar for monthly subscriptions – upping it by $5/month. I’m sure that this will force people to move networks, however I’m not sure how many will remain as customers of Cingular and knowing the USA will probably trigger a few more class action lawsuits.

VZW’s revenues are catching up fast with Cingular and VZW will in all probability overtake Cingular before the end of the year, even in terms of service revenue.

As I mentioned before Cingular are currently in the process of turning off its’ TDMA and Analogue network which are both due to be turned off in early 2008. I’m sure that this will reduce their cost base, but don’t think by enough to catch up with VZW. The Cingular marketing brains have come up with a rather unique way of forcing people to move networks – by raising the bar for monthly subscriptions – upping it by $5/month. I’m sure that this will force people to move networks, however I’m not sure how many will remain as customers of Cingular and knowing the USA will probably trigger a few more class action lawsuits.

<< Home