Free Cash Flow

In

today's results to 30th June, Sky revealed it generated £563m of FCF in the year. This is after total capital expenditure of £212m (including £37m on LLU unbundling), but before £209m on the purchase of Easynet. Sky can easily afford it’s capital broadband plans of £250m over the next couple of years (£130m – fixed and £120m – success based). It can also easily afford the £290 of cash operating losses.

The scary thing for the competition is that the cash-generating part of the business is remarkably capex light. Sky only spent £212m on capex, of which £37m was on unbundling exchanges. Furthermore another big chunk of the capex (£38m) was spent on upgrading IT support systems which will be shared with the new broadband business.

Transmission Costs

One thing that should frighten the Telco’s is how cheap Sky’s transmission costs currently are: in 2006 they were £171m for the TV business which is flat year-on-year. Total transmission costs increased by £63m because of the Easynet network costs, which was only acquired at the beginning of January so yearly run-rate on the fixed network that Sky have acquired and building will probably be at around the same rate as the whole of the TV transmission, once the LLU build out is finished. If we conservatively just look at the DTH revenues, transmission costs are only 5.4% of revenues. If you consider the bandwidth that this delivers, this is an absolute huge advantage compared to DTT (Freeview), Cable or Copper.

Content Investment

Sky spent £1.6bn on programming – this is huge barrier to entry to anyone thinking of entering the content business, especially when you consider the Sky bundling approach. The spend on Sport is the largest chunk of this is an incredible £766m – how anyone else in the UK can compete with this is beyond me. Sport is obviously the cornerstone that drives Sky forward. Movie costs were £310m which is in absolute decline (down £33m y-o-y and the lowest figure for six years). News & Entertainment costs were £200m, an increase of £20m because of an increase in own cost & commissioned programming. Third party channel costs fell to £323m (a drop of £39m) and the third party channel cost per subscriber is £3.37/month.

The overall trend is what interests me: Sky is spending less with third parties and spending more on generating its’ own unique content, whether internal, (eg SkyNews) commissioned (eg SkyOne) or rights-based (eg exclusive Sports Rights).

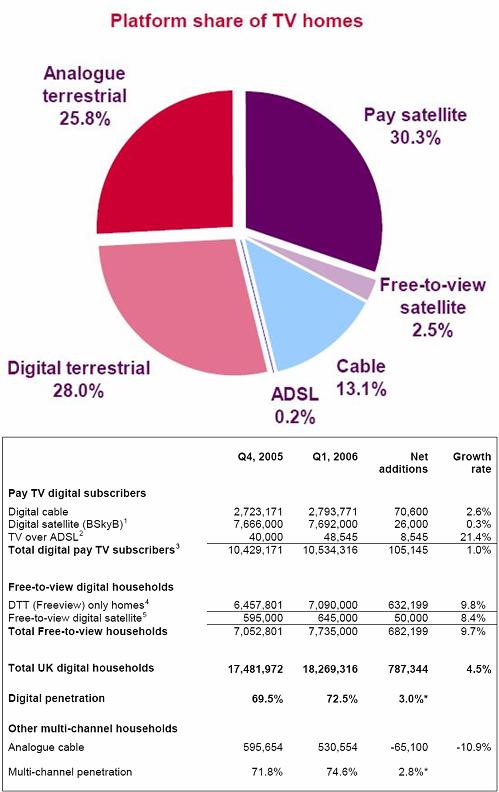

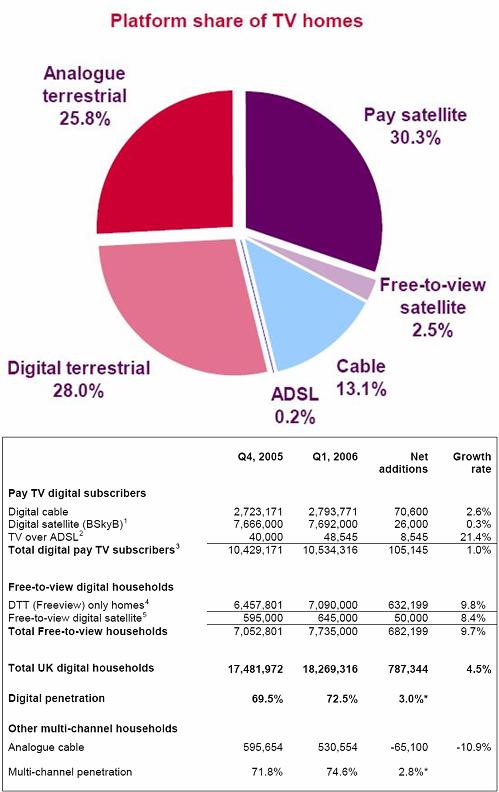

Digital Penetration – core business growth

I don’t think Sky’s growth in its’ TV service is by any means complete:

- First – it is going to add new subscribers to Sky. Sky’s targets around 400k a year which is about £156m/annum at current ARPU rates. I don’t think this is a stretch at all and could quite easily grow the 500k per annum which would add £200m/annum

- Second – there is big upselling opportunities on the base – only 13% take up multi-room, HD has only just launched (again Sky are technologically in the lead) and there are the people who will upgrade the bundle (around 45% take Sports + Movies + All Channels)

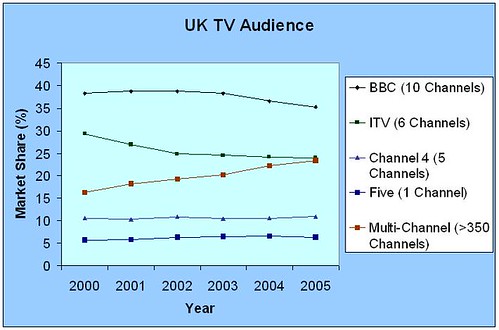

- Third, additional revenue streams such as Advertising Revenue will improve as audience share improves. Wholesale content seems to be stable which they attribute to Cable losing net premium customers.

- Finally and this is where the telco’s will be really envious – Sky actually increases product prices on a yearly basis!

Once you add up all the elements you could quite easily see Sky growing its’ core business revenues at 5-10% per annum. Sky’s business model is also extremely leveraged so I can see profit and cashflow growing at a quicker rate (7.5%-15% pa)

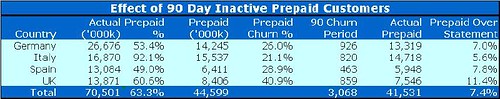

This is a nice business before you add in the home telephony and internet business, both of which should increase the value of the TV business through increased customer loyalty. 1% of churn reduction is £50m/annum saving in customer acquisition costs.

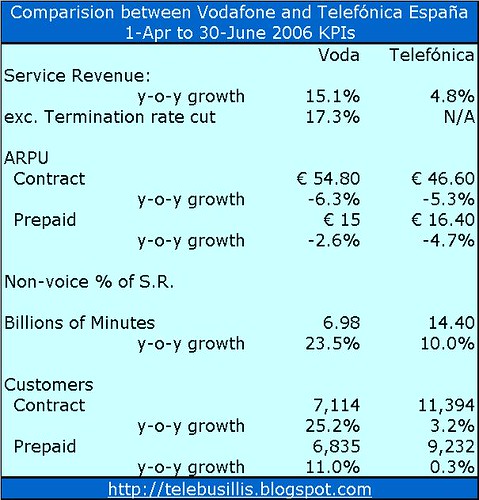

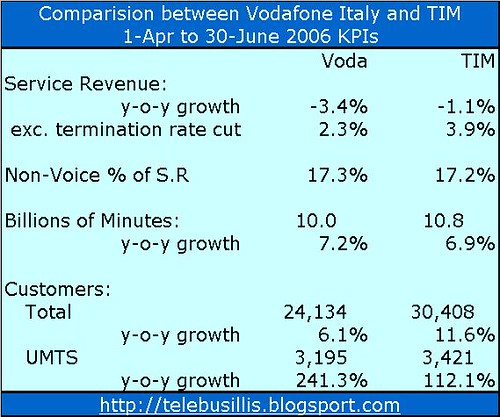

Differentiation

It is obvious that Sky are placing a big investment in customer care and home engineers and I suspect they are building a “digital walled garden” – if you want the best quality, features and service join the Sky Club. Carphone Warehouse are obviously taking the “value” dumb pipe approach and BT will like to play the Sky game, but don’t have the content, but do have years of telco/internet experience lead and I suspect have a far more “less digital” customer base who love analogue TV and the BBC. I’m not sure where Orange is placing themselves or o2 once they join the playing field.

I am also sure that Sky’s EPG (Electronic Programming Guide) will be a critical differentiator in the Video camp. If Google is premier Gateway for information retrieval and MySpace is the premier Gateway for Social Networking, the Sky EPG will be premium gateway for video whether on the net or broadcast. This will be a bit asset in the future.

Murdoch Snr

Murdoch Jnr’s Dad gave an i

nterview the other day and it is obvious that the BSkyB model will be replicated in Italy and the USA. His comments about commission rates for advertising on MySpace will have sent a shudder down the spine of Google. I’m almost sure that BskyB will not get any sort of exclusivity on Myspace content as it expands overseas. It is obvious that the whole of the Mudoch Empire is not thinking about convergence, but implementing it...

Personally, I think BSkyB is looking the strongest going into the UK BroadBand Wars.