Qualcomm Quandary

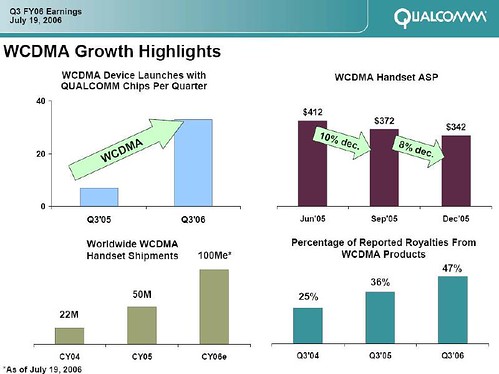

47% of Royalties from WCDMA accounts for US$334m in the current quarter – this is a huge high margin business (circa. 90% at the EBIT level!!) and is growing much quicker than the traditional CDMA line of business.

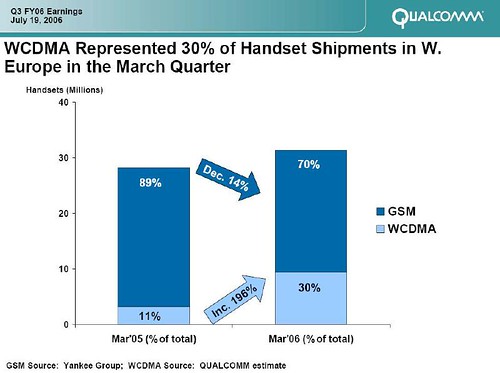

With WCDMA accounted for 30% of handset shipments in Western Europe, I can quite easily Christmas 2006 being the tipping point when more WCDMA handsets are shipped than GSM in a few European markets.

The Qualcomm business model is one where R&D leads to technology licensing and royalty payments, but a vital and growing part is that equipment providers use the Qualcomm chipsets for their products rather than other competitors (eg TI, Freescale) It is much more difficult to work out the Qualcomm share of the WCDMA chip market.

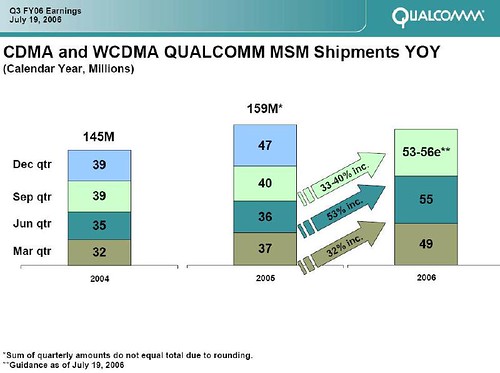

The chip business is growing nicely but not as fast as the WCDMA market, this may be because the chip figures are comingled (ie WCDMA+CDMA), but more than likely is that because unlike the CDMA market where Qualcomm dominates, I don’t think it does in the WCDMA market. I believe that Nokia and SonyEricsson use the TI basebands, Motorola uses the Freescale band and Samsung and LG use the Qualcomm baseband. Irwin Jacobs set a target of 50% of the baseband market and I think Qualcomm will have to work extremely hard to get that level of market share. On the upside, Qualcomm have a lot of market share to fight for in the chip business.

If I was Qualcomm, I would consider doing an acquisition which would throw the other chipmakers into turmoil – buy ARM who provides the Intellectual Property and Blueprints for the majority of CPUs in the basebands. ARM would cost Qualcomm around US$3bn which really is petty cash to Qualcomm. They could quite easily argue that Qualcomm needs a CPU engine to compete with Intel’s movement into the wireless space.

Although small, Qualcomm other leg of the tripod – the Strategic Initiatives – has always been where Qualocmm have used its’ balance sheet to finance start-up losses of new ventures to grow the use of its’ technology base. Currently, it seems the focus is the MediaFlo or broadcast TV business.

On another level, the Qualcomm results and strategy provide an insight into the forthcoming supa-fight between Nokia and Qualcomm. Both companies are titans and play in the same technological field, but look to different parts of the value chain to deliver profits. This is another fascinating battle which is occurring and is as, if not more interesting as the battle between the MNOs and governments for the excessive profits that oligopolies throw off.

<< Home