Vodafone MobilePlus in the UK market - part II

The second part of Geitner’s MobilePlus strategy related to Fixed Substitution. This posting looks at the residential market and draws heavily data from the public OFCOM Communication Market reports, especially the recent Nations & Regions reports collated from market research taken during the second half of 2005.

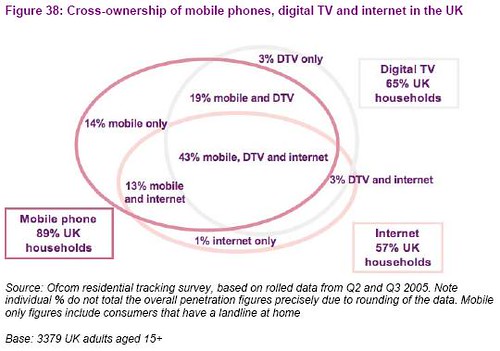

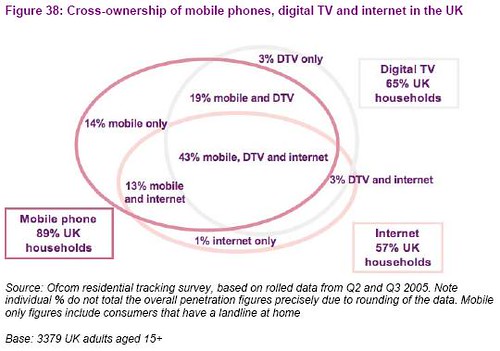

• 43% of UK adults say they have taken up three of the four main communications platforms: mobile phones, digital TV and the internet at home.

• Take-up of telephone landlines stands at 91% of UK adults. 80% of UK adults say they personally use a mobile phone. Of all those not taking up mobile phones, the majority (87%) are happy using their existing landline service. 12% cite difficulty using as a reason and 11% cite expense.

• 8% of UK adults say they rely solely on mobile phones for their telecommunications needs. People relying solely on mobile phones tended to be younger than the population as a whole; they are more likely to be in C2DE social grades and use pay as-you-go services.

• Two thirds of UK adults live in households with a PC, with 57% of adults having access to the internet. Of those not taking up the internet, 81% say that they have no interest or need. 18% cite expense as a reason.

• Across the UK, 63% of internet households say that they have taken up broadband connections.

• 3.2% of average weekly household disposable income is spent on communications services across the UK. Around two thirds of this is spent on telecommunications (landline and mobile), with the remaining third on broadcast and internet services.

• Satisfaction with internet and telecoms services is high, ranging between 89% UK overall internet satisfaction and 93% UK overall landline satisfaction.

• Every week across the UK, adults say they make, on average, over 20 calls on their mobile phones and send 28 text messages.

There are a few shockers in this ream of data for the mobile operators

• mobile only houses tend to be poor and stuck in pay-as-you-go mode. These are not the type of customers you give free handsets to, let alone a home gateway.

• In order to increase penetration of internet, they’ll either have to convince people to buy a PC or bundle it into the overall package

• Overall satisfaction is extremely high – which implies to me the main reason people are churning is for price reasons.

• the sweet spot of convergence is already well served, however by different suppliers.

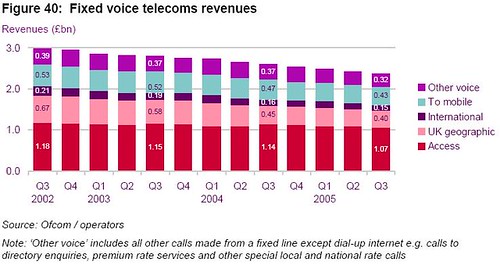

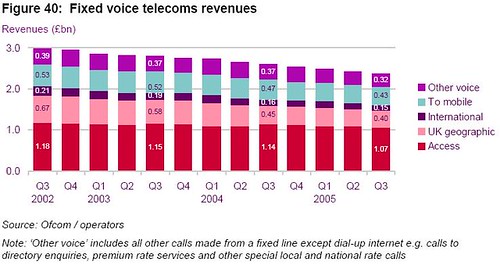

One look at the fixed voice revenues makes me think Vodafone must be crazy to enter the market, because of two factors:

• the market is declining and declining fast; and

• the only part which looks nice is the “access” which the part that Vodafone says it is not going to enter.

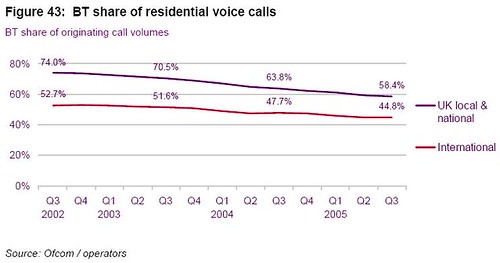

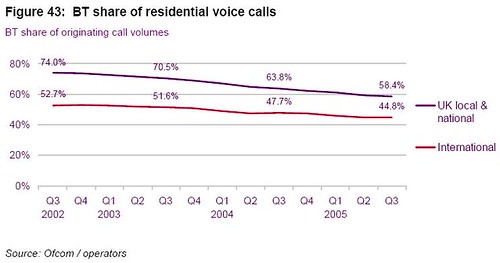

It also is apparent why LLU, thereby attracting a proportion of the access revenues, is so appealing to the fixed-line players such as Bulldog (C&W) and TalkTalk. It is also apparent that it is not as easy as 5 years ago with a lot of the minutes already having been churned away from the incumbent.

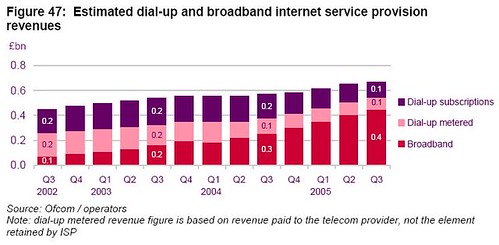

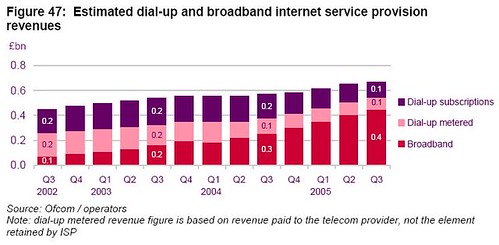

Again looking at broadband access revenues the market is nowhere as great as the mobile market.

The further difficulty is the profitability in this area: TalkTalk are offering for £21/month a bundle of access + broadband + UK geographical + International Calls (to the majority of countries) This is almost impossible to match (profitably) without owning own infrastructure and LLU capabilities.

Given that the UK market is not as appealing as the original Geitner slide, the only rational reason I can see for Vodafone entering the market in the UK is defensive: ie protecting their own base. This implies to me a further reduction in margins in the UK base.

There is another reason, which the cynic in me has more time believing, in that Sarin was short of a strategy and because the Germans owned a fixed-line division and the market is completely different – they have delivered a fixed convergence strategy which will only currently work in Germany.

In the UK, I would definitely be looking at which assets I could buy which would make the strategy work – the acquisition of BT or C&W would be top of the list. C&W would definitely work if it was combined with the purchase of AOL Europe.

• 43% of UK adults say they have taken up three of the four main communications platforms: mobile phones, digital TV and the internet at home.

• Take-up of telephone landlines stands at 91% of UK adults. 80% of UK adults say they personally use a mobile phone. Of all those not taking up mobile phones, the majority (87%) are happy using their existing landline service. 12% cite difficulty using as a reason and 11% cite expense.

• 8% of UK adults say they rely solely on mobile phones for their telecommunications needs. People relying solely on mobile phones tended to be younger than the population as a whole; they are more likely to be in C2DE social grades and use pay as-you-go services.

• Two thirds of UK adults live in households with a PC, with 57% of adults having access to the internet. Of those not taking up the internet, 81% say that they have no interest or need. 18% cite expense as a reason.

• Across the UK, 63% of internet households say that they have taken up broadband connections.

• 3.2% of average weekly household disposable income is spent on communications services across the UK. Around two thirds of this is spent on telecommunications (landline and mobile), with the remaining third on broadcast and internet services.

• Satisfaction with internet and telecoms services is high, ranging between 89% UK overall internet satisfaction and 93% UK overall landline satisfaction.

• Every week across the UK, adults say they make, on average, over 20 calls on their mobile phones and send 28 text messages.

There are a few shockers in this ream of data for the mobile operators

• mobile only houses tend to be poor and stuck in pay-as-you-go mode. These are not the type of customers you give free handsets to, let alone a home gateway.

• In order to increase penetration of internet, they’ll either have to convince people to buy a PC or bundle it into the overall package

• Overall satisfaction is extremely high – which implies to me the main reason people are churning is for price reasons.

• the sweet spot of convergence is already well served, however by different suppliers.

One look at the fixed voice revenues makes me think Vodafone must be crazy to enter the market, because of two factors:

• the market is declining and declining fast; and

• the only part which looks nice is the “access” which the part that Vodafone says it is not going to enter.

It also is apparent why LLU, thereby attracting a proportion of the access revenues, is so appealing to the fixed-line players such as Bulldog (C&W) and TalkTalk. It is also apparent that it is not as easy as 5 years ago with a lot of the minutes already having been churned away from the incumbent.

Again looking at broadband access revenues the market is nowhere as great as the mobile market.

The further difficulty is the profitability in this area: TalkTalk are offering for £21/month a bundle of access + broadband + UK geographical + International Calls (to the majority of countries) This is almost impossible to match (profitably) without owning own infrastructure and LLU capabilities.

Given that the UK market is not as appealing as the original Geitner slide, the only rational reason I can see for Vodafone entering the market in the UK is defensive: ie protecting their own base. This implies to me a further reduction in margins in the UK base.

There is another reason, which the cynic in me has more time believing, in that Sarin was short of a strategy and because the Germans owned a fixed-line division and the market is completely different – they have delivered a fixed convergence strategy which will only currently work in Germany.

In the UK, I would definitely be looking at which assets I could buy which would make the strategy work – the acquisition of BT or C&W would be top of the list. C&W would definitely work if it was combined with the purchase of AOL Europe.

<< Home