Vodafone MobilePlus in the UK market - part I

Vodafone put some flesh on one element of its’ new strategy – MobilePlus, I specifically wanted to look at that strategy in the context of the UK Market.

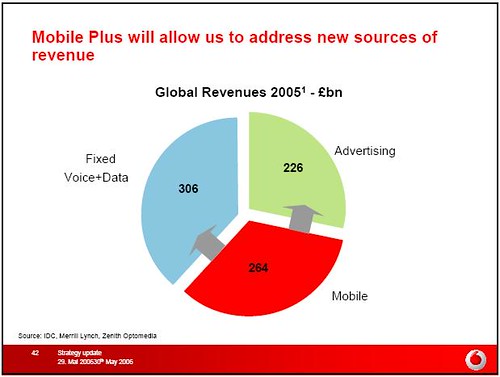

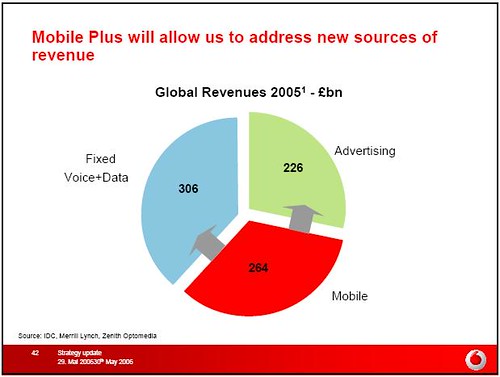

The first slide from Thomas Geitner was an explanation of the size of the relevant markets that Vodafone were addressing which looked pretty impressive at first glance for growth

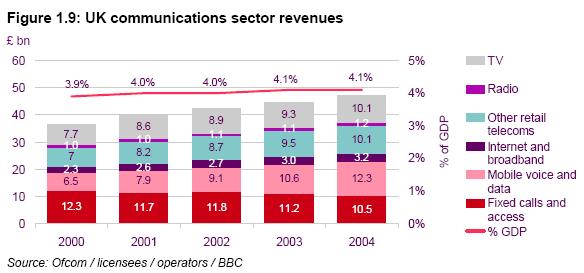

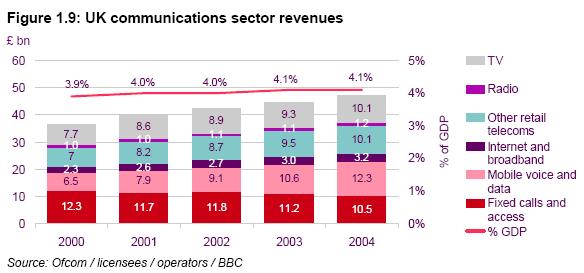

If we look at comparable figures from OFCOM relating to the UK market:

It can be argued that Vodafone competes in all the sectors already with products & services such as:

• TV Sector – MobileTV

• Radio Sector – RadioDJ

• Other retail telecoms – Vodafone Stores

• Internet & Broadband – 3G Data Cards

• Mobile Voice & Data – Core Product

• Fixed Calls & Access – “Fixed to Mobile” substitution products.

In fact comparing Vodafone UK (Mar2004-Mar2005) turnover of £5.065 with the total end-user communications market (for 2004) of £47.4bn (net of £8.6bn which was for wholesale telecoms) gives Vodafone’s current overall market share of 11.9%.

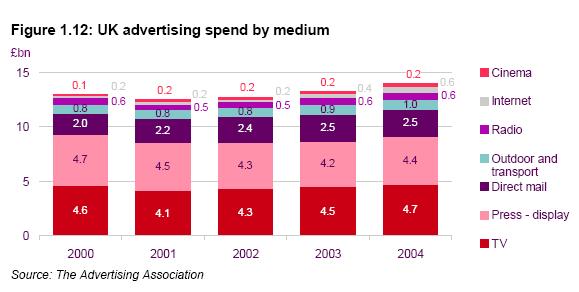

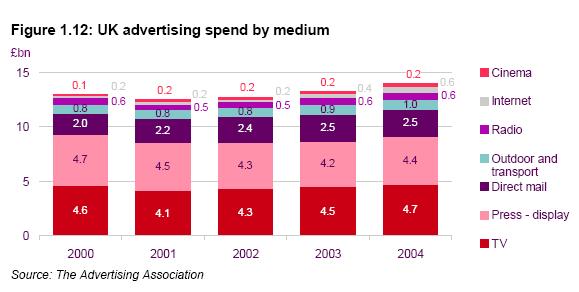

Most of the advertising spend is already included in these figures, but if we look at this market in detail:

It is interesting to see that the UK Advertising Market of £14bn is actually larger than the UK Mobile industry of £12.3bn. However, the real addressable market is much, much smaller. The internet is the faster growing segment (46% growth in 2004) and in 2005 has overtaken both Radio and Outdoor Advertising in terms of market size. Currently, even if Vodafone gained 100% of all internet advertising it would only account for around 10% of total Vodafone UK revenues. I suspect it will be many years before advertising is a significant factor in Vodafone Revenue Analysis.

However, the genius of Geitner’s strategy is that it is sending a big sign that Vodafone is willing to alter its’ business model to fight the internet companies at their own game. I am willing to bet that if you asked you’re average teenager how much Instant Messaging (IM) services cost they say would reply nothing. IM services seem to be becoming with the advent of ADSL and home WiFi an always-on service for teenagers. Even whilst watching the TV, teenagers seem to be providing a parallel running commentary amongst their mates.

The big issue for Vodafone is that IM services compete direct with SMS services which accounting for £705m of turnover in 2005 and is actually growing. Using VOD’s active base of 14,413k customers, this gives a run-rate of around £4/month. It is obvious that a potential option is change the business model to the IM one: split the SMS charges into one part for access and another for the service one supported by monthly subscription cost and another by advertising.

I would like to see a Vodafone branded service aimed at the teenage market which is a flat rate messaging package (SMS, IM or email) all linked together with a presence package which works both on the PC and handset with the PC end supported by advertising. I feel this is the aim of the advertising package and was in fact one of the applications hinted at by Geitner. This approach has the upside that Vodafone is currently poorly represented in the “youth” segment and they can probably afford to take a few risks without too much cannibalisation.

The challenge Vodafone has to address is the community one – one where MSN throws its weight around because of the number of users, similarly with MySpace, Google, Yahoo, etc. The mobile industries typical approach has been to get a service to be interoperable and then compete on price. I would like to see a braver approach by Vodafone, where it introduces a service (eg Live! Messenging) and says you need a Vodafone handset and voice service to get the full benefits. For sure you can text people on T-Mobile, O2 etc and for sure you can IM MSN customers. However to get the full mobility and PC presence – your mates need to be a Vodafone customer, the service is accessible through the Live portal and you see Live adverts.

I would like to think this is the area that Vodafone is going to take in the advertising market. ie Turning its’ strength in the mobile access side of the equation into entry into a new area – the PC services business without playing the typical mobile game of full interoperability and price competition.

This is obviously an area where VOD is extending into a new area - PC services, in the next part I'll look at the area of Fixed Mobile Substitution.

The first slide from Thomas Geitner was an explanation of the size of the relevant markets that Vodafone were addressing which looked pretty impressive at first glance for growth

If we look at comparable figures from OFCOM relating to the UK market:

It can be argued that Vodafone competes in all the sectors already with products & services such as:

• TV Sector – MobileTV

• Radio Sector – RadioDJ

• Other retail telecoms – Vodafone Stores

• Internet & Broadband – 3G Data Cards

• Mobile Voice & Data – Core Product

• Fixed Calls & Access – “Fixed to Mobile” substitution products.

In fact comparing Vodafone UK (Mar2004-Mar2005) turnover of £5.065 with the total end-user communications market (for 2004) of £47.4bn (net of £8.6bn which was for wholesale telecoms) gives Vodafone’s current overall market share of 11.9%.

Most of the advertising spend is already included in these figures, but if we look at this market in detail:

It is interesting to see that the UK Advertising Market of £14bn is actually larger than the UK Mobile industry of £12.3bn. However, the real addressable market is much, much smaller. The internet is the faster growing segment (46% growth in 2004) and in 2005 has overtaken both Radio and Outdoor Advertising in terms of market size. Currently, even if Vodafone gained 100% of all internet advertising it would only account for around 10% of total Vodafone UK revenues. I suspect it will be many years before advertising is a significant factor in Vodafone Revenue Analysis.

However, the genius of Geitner’s strategy is that it is sending a big sign that Vodafone is willing to alter its’ business model to fight the internet companies at their own game. I am willing to bet that if you asked you’re average teenager how much Instant Messaging (IM) services cost they say would reply nothing. IM services seem to be becoming with the advent of ADSL and home WiFi an always-on service for teenagers. Even whilst watching the TV, teenagers seem to be providing a parallel running commentary amongst their mates.

The big issue for Vodafone is that IM services compete direct with SMS services which accounting for £705m of turnover in 2005 and is actually growing. Using VOD’s active base of 14,413k customers, this gives a run-rate of around £4/month. It is obvious that a potential option is change the business model to the IM one: split the SMS charges into one part for access and another for the service one supported by monthly subscription cost and another by advertising.

I would like to see a Vodafone branded service aimed at the teenage market which is a flat rate messaging package (SMS, IM or email) all linked together with a presence package which works both on the PC and handset with the PC end supported by advertising. I feel this is the aim of the advertising package and was in fact one of the applications hinted at by Geitner. This approach has the upside that Vodafone is currently poorly represented in the “youth” segment and they can probably afford to take a few risks without too much cannibalisation.

The challenge Vodafone has to address is the community one – one where MSN throws its weight around because of the number of users, similarly with MySpace, Google, Yahoo, etc. The mobile industries typical approach has been to get a service to be interoperable and then compete on price. I would like to see a braver approach by Vodafone, where it introduces a service (eg Live! Messenging) and says you need a Vodafone handset and voice service to get the full benefits. For sure you can text people on T-Mobile, O2 etc and for sure you can IM MSN customers. However to get the full mobility and PC presence – your mates need to be a Vodafone customer, the service is accessible through the Live portal and you see Live adverts.

I would like to think this is the area that Vodafone is going to take in the advertising market. ie Turning its’ strength in the mobile access side of the equation into entry into a new area – the PC services business without playing the typical mobile game of full interoperability and price competition.

This is obviously an area where VOD is extending into a new area - PC services, in the next part I'll look at the area of Fixed Mobile Substitution.

<< Home