UK Broadband: Coming Soon - 3m LLU lines

The latest OpenReach kpi’s show that we are currently are at 2,943,414 unbundled lines as of 26th Aug which means that at current run rates we should be at over 3m sometime this week.

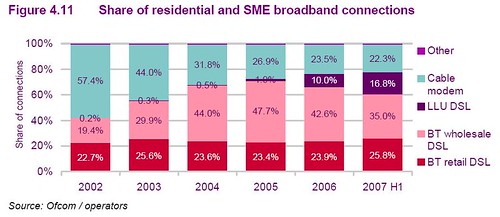

The fears that unbundling was slowing seem to been unfounded and current quarter net additions are running at 58k/week compared to 42k/week in Q2. Q3 is already at 519k net adds with a full month to go compared to 513k in the whole of Q2. Even better news for the unbundlers is that the churn rates appear to dropping: I estimate a full 3% in the current quarter to 27% annualised.

I suspect that the players with big ipstream (or BT Wholesale DSL in the graph) bases are very busy moving their customers onto LLU DSL. I’m expecting really good porting numbers this quarter from Carphone (AOL/TalkTalk), Tiscali and Orange.

I’m also expecting that smaller ISPs are really feeling the heat this summer from the cut price unbundlers and I wouldn’t be at all surprised to see further shrinkage in the “other” base. The light at the end of the tunnel for these players is BTs 21CN WBC product and the hope that a specialist wholesaler, such as Entanet, will be able to develop some niche products and aggregate enough demand with the smaller players to make it all worthwhile for everyone.

A cursory glance at the WBC product indicates that some scale is required (ballpark initial guess - a minimum of 100k customers) and therefore a wholesale/retail approach is probably optimal for the "others". In the first generation broadband era, Tiscali fulfilled this wholesale role, but I think second time around Tiscali will be too focused on fighting the behemoths in the consumer segment to make a real go of wholesaling. But then again, I always seem to underestimate Tiscali and remember Tiscali currently has around 300k wholesale customers which is a big chunk of the market.

The stand out offer so far this quarter was the Orange Free (or Discounted) LapTop deal with PCWorld – it seemed to sell out so fast that it is obvious there is huge demand for this type of product in the market. I suspect that Orange are being cautious and wanting to see the returns, fraud, usage rates and support costs on a small sample before committing to a huge investment.

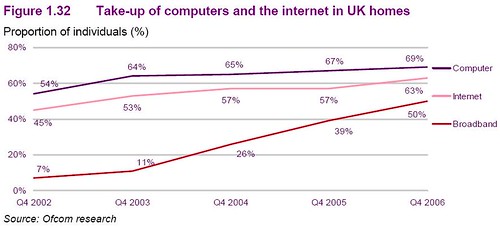

As the graph below shows nearly all home computer users already have the internet and they nearly all have broadband connections. The “Free LapTop” offers have the potential to bring a lot more households into the market quicker than expected.

All the indications are that the AOL Free Laptop will be a huge success in terms of sales especially in the run rate to Christmas. I would imagine that Carphone could easy flog 250k if they were feeling really brave – I estimate that the SAC would be around £270 and 250k would be an £67.5m investment which is serious money for Carphone.

I also wouldn’t be surprised if the initial results of the Orange Free LapTop “Beta test” programme give the UK management enough courage to put a lot of subsidy into the market: £67.5m is a lot of money for Carphone, but a drop in the Bay of Biscay for Orange.

The other recent interesting development is that Be* is back advertising with banner ads all across the net and has revised its tariffs and product specs. I suspect the new owner of Be, O2/Telefonica, are building demand to test systems and processes before a full launch. However, I think O2 will have to do something more exciting than the Be* tariffs to create even a flicker in the market.

The biggest news of the quarter so far is the biggest gossip which is that Sky are getting ready to launch a standalone broadband and broadband/home phone dual play targeting the Freeview homes. This was broken on the non-official SkyUser forum and came about because they recognized that SkyPicnic and variants of it were being registered as domains, unofficial comment apparently from within Sky seem to indicate that the product is a standalone broadband product with a new sexy-looking Netgear router.

While some people are getting excited about this product, I personally will see the launch, if it ever happens, as the first real chink in the armour of Sky. The original broadband business model was all based upon reduction in churn in the payTV business and upsale of new products thereby increasing the ARPU.

Of course, Sky Broadband is nearly one year old and a lot has been learnt about the economics of unbundling since that date – mainly that it will take around 2.5 million customers to make the effort worthwhile and that is with the majority taking both a voice and broadband product.

If Sky launches a Picnic product – the first question that I would ask is Sky worried about reaching the scale from its PayTV customers alone? The next question is whether there is a fall in demand from the PayTV base? It currently seems that Sky has capacity for around 250k additions/quarter. Are Sky adding extra provisioning and support capacity?

I would need a lot of convincing to be assured that a Sky Picnic type product isn’t the first hiccup in the BSkyB master plan.

The fears that unbundling was slowing seem to been unfounded and current quarter net additions are running at 58k/week compared to 42k/week in Q2. Q3 is already at 519k net adds with a full month to go compared to 513k in the whole of Q2. Even better news for the unbundlers is that the churn rates appear to dropping: I estimate a full 3% in the current quarter to 27% annualised.

I suspect that the players with big ipstream (or BT Wholesale DSL in the graph) bases are very busy moving their customers onto LLU DSL. I’m expecting really good porting numbers this quarter from Carphone (AOL/TalkTalk), Tiscali and Orange.

I’m also expecting that smaller ISPs are really feeling the heat this summer from the cut price unbundlers and I wouldn’t be at all surprised to see further shrinkage in the “other” base. The light at the end of the tunnel for these players is BTs 21CN WBC product and the hope that a specialist wholesaler, such as Entanet, will be able to develop some niche products and aggregate enough demand with the smaller players to make it all worthwhile for everyone.

A cursory glance at the WBC product indicates that some scale is required (ballpark initial guess - a minimum of 100k customers) and therefore a wholesale/retail approach is probably optimal for the "others". In the first generation broadband era, Tiscali fulfilled this wholesale role, but I think second time around Tiscali will be too focused on fighting the behemoths in the consumer segment to make a real go of wholesaling. But then again, I always seem to underestimate Tiscali and remember Tiscali currently has around 300k wholesale customers which is a big chunk of the market.

The stand out offer so far this quarter was the Orange Free (or Discounted) LapTop deal with PCWorld – it seemed to sell out so fast that it is obvious there is huge demand for this type of product in the market. I suspect that Orange are being cautious and wanting to see the returns, fraud, usage rates and support costs on a small sample before committing to a huge investment.

As the graph below shows nearly all home computer users already have the internet and they nearly all have broadband connections. The “Free LapTop” offers have the potential to bring a lot more households into the market quicker than expected.

All the indications are that the AOL Free Laptop will be a huge success in terms of sales especially in the run rate to Christmas. I would imagine that Carphone could easy flog 250k if they were feeling really brave – I estimate that the SAC would be around £270 and 250k would be an £67.5m investment which is serious money for Carphone.

I also wouldn’t be surprised if the initial results of the Orange Free LapTop “Beta test” programme give the UK management enough courage to put a lot of subsidy into the market: £67.5m is a lot of money for Carphone, but a drop in the Bay of Biscay for Orange.

The other recent interesting development is that Be* is back advertising with banner ads all across the net and has revised its tariffs and product specs. I suspect the new owner of Be, O2/Telefonica, are building demand to test systems and processes before a full launch. However, I think O2 will have to do something more exciting than the Be* tariffs to create even a flicker in the market.

The biggest news of the quarter so far is the biggest gossip which is that Sky are getting ready to launch a standalone broadband and broadband/home phone dual play targeting the Freeview homes. This was broken on the non-official SkyUser forum and came about because they recognized that SkyPicnic and variants of it were being registered as domains, unofficial comment apparently from within Sky seem to indicate that the product is a standalone broadband product with a new sexy-looking Netgear router.

While some people are getting excited about this product, I personally will see the launch, if it ever happens, as the first real chink in the armour of Sky. The original broadband business model was all based upon reduction in churn in the payTV business and upsale of new products thereby increasing the ARPU.

Of course, Sky Broadband is nearly one year old and a lot has been learnt about the economics of unbundling since that date – mainly that it will take around 2.5 million customers to make the effort worthwhile and that is with the majority taking both a voice and broadband product.

If Sky launches a Picnic product – the first question that I would ask is Sky worried about reaching the scale from its PayTV customers alone? The next question is whether there is a fall in demand from the PayTV base? It currently seems that Sky has capacity for around 250k additions/quarter. Are Sky adding extra provisioning and support capacity?

I would need a lot of convincing to be assured that a Sky Picnic type product isn’t the first hiccup in the BSkyB master plan.

<< Home