UK LLU Economics

Over the past month I have been a busy bee developing a generic model for LLU economics and trying to work out if there is a sting or honey for shareholders. I have based my work on detailed models developed by Jonathan Lishawa who to be perfectly fair has provided most of the brainpower. Jonathan has in the past held senior positions in the LLU industry and consults on broadband strategy for merchant banks and investment funds so knows what he is on about.

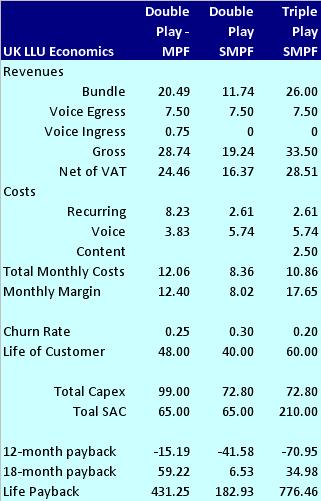

Here is the ten thousand mile view for three "example" services:

A key assumption in the example above is that it is based upon 2.5m customers spread across 1,500 exchanges. It also assumes that none of the capex is acquired via M&A and therefore is apportioned to each customer. It is also assumed that churn will be lower for the triple play than MPF or SMPF double plays. Also included in the SAC costs for the triple play bundle is a set top box, wireless modem and site visit.

By playing with the variables, it is also noticeable that the recent TalkTalk £16 package will be cutting the margin extremely close to bone, especially given that an assumption in the model is that the backhaul circuits are provided using the new Openreach BNS1000 product which is extremely cheap and really only of use to companies with a reasonable sized backbone. ie not TalkTalk.

Similarly, the Sky broadband products are also hard to justify on a standalone basis and I can only get them to work by significant reductions in churn on the core payTV product for existing customers. However, a Triple play customer is quite attractive if they are new to payTV.

Sky and TalkTalk both have 18-month contracts and therefore the capital is paid back over the length of the contract. However, in the case of Tiscali which is a 12-month contract and a SMPF/CPS service there is a much bigger risk. The promotional pricing of £9.99 for 3 months and £12.99 for twelve months does not appear to cover the capital costs within a twelve month contract even with a £7.50 gross additional voice revenue.

BT Retail does not provide a LLU service, but instead uses ipstream and cps. Having said that with a £13.99 price for 6 months and £22.99 for the next 12 months, BT would be much more profitable than the rest – even with a much more expensive CPE – the Home Hub is much higher spec than the traditional bundled modem offered by the rest.

One of the key variables which is in the model is the support costs which are estimated at £1.57/month/customer. This could be said to be slightly optimistic and only be valid if the customer very infrequently calls the help line. In order words, the service itself would have be of an extremely high quality with low network failures and more importantly very accurate billing.

The Bill&Collect processes in general and the systems to support billing (OSS) are normally where Communication Providers struggle to keep costs under control. Nearly everyone who moves from a fixed tariff environment (ie monthly rentals) to variable tariff environment (ie rating individual calls) are always surprised by how expensive it is to produce bills and collect the money. Most of the OSS costs are in capex rather than opex and therefore the costs are hidden when looking just at EBITDA figures.

Here is the ten thousand mile view for three "example" services:

A key assumption in the example above is that it is based upon 2.5m customers spread across 1,500 exchanges. It also assumes that none of the capex is acquired via M&A and therefore is apportioned to each customer. It is also assumed that churn will be lower for the triple play than MPF or SMPF double plays. Also included in the SAC costs for the triple play bundle is a set top box, wireless modem and site visit.

By playing with the variables, it is also noticeable that the recent TalkTalk £16 package will be cutting the margin extremely close to bone, especially given that an assumption in the model is that the backhaul circuits are provided using the new Openreach BNS1000 product which is extremely cheap and really only of use to companies with a reasonable sized backbone. ie not TalkTalk.

Similarly, the Sky broadband products are also hard to justify on a standalone basis and I can only get them to work by significant reductions in churn on the core payTV product for existing customers. However, a Triple play customer is quite attractive if they are new to payTV.

Sky and TalkTalk both have 18-month contracts and therefore the capital is paid back over the length of the contract. However, in the case of Tiscali which is a 12-month contract and a SMPF/CPS service there is a much bigger risk. The promotional pricing of £9.99 for 3 months and £12.99 for twelve months does not appear to cover the capital costs within a twelve month contract even with a £7.50 gross additional voice revenue.

BT Retail does not provide a LLU service, but instead uses ipstream and cps. Having said that with a £13.99 price for 6 months and £22.99 for the next 12 months, BT would be much more profitable than the rest – even with a much more expensive CPE – the Home Hub is much higher spec than the traditional bundled modem offered by the rest.

One of the key variables which is in the model is the support costs which are estimated at £1.57/month/customer. This could be said to be slightly optimistic and only be valid if the customer very infrequently calls the help line. In order words, the service itself would have be of an extremely high quality with low network failures and more importantly very accurate billing.

The Bill&Collect processes in general and the systems to support billing (OSS) are normally where Communication Providers struggle to keep costs under control. Nearly everyone who moves from a fixed tariff environment (ie monthly rentals) to variable tariff environment (ie rating individual calls) are always surprised by how expensive it is to produce bills and collect the money. Most of the OSS costs are in capex rather than opex and therefore the costs are hidden when looking just at EBITDA figures.

<< Home