UK Broadband – Unbundled Exchange Analysis

One of the big questions that crosses my mind whenever I hear companies quoting the number of exchanges unbundled is how this is reflected in coverage and number of homes marketable. The answer of course lies in a deep analysis of the data and there is no better source of unbundling statistics than Samknows, who kindly authorised my access to his database.

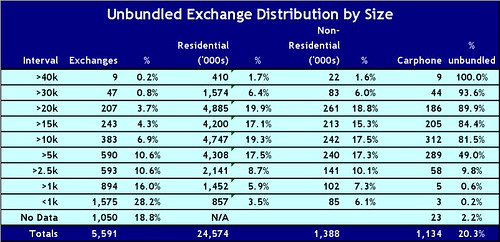

The source of the data is an analysis of residential and non-residential properties per exchange, sadly there is no data for Northern Ireland so the 668k NI residences are excluded. If anyone has this type of data (royalty free), please get in touch on the tittle-tattle line. This data is then correlated against BT exchange & post code coverage. This data is validated anytime someone makes a query against the samknows database and given over 4m queries have taken place the data is pretty accurate.

An analysis of this data gives that it is possible to cover 65% (approx. 15.8m) UK households by unbundling the 890 exchanges with more than 10k households. If all exchanges with greater than 5k households are unbundled, an additional 590 exchanges would yield 4.3m households – in total unbundling 1,480 exchanges gives 82% coverage or 20.1m homes.

Of course not all exchanges will be economic to be unbundled especially if the backhaul costs are pretty expensive. This will be dependent upon distance of the exchange from the local pop’s and availability of dark fibre at the exchange.

For instance, a quick look at the Sky fibre backbone network explains why exchanges such as Exeter (38k) and Scunthorpe (32k) haven’t yet been unbundled by Sky despite the large volume of households. For Carphone, the situation is even worse with them only having three pops in Brentford, Birmingham and Irlam – the backhaul costs will be a limit on profits until a larger backbone is built.

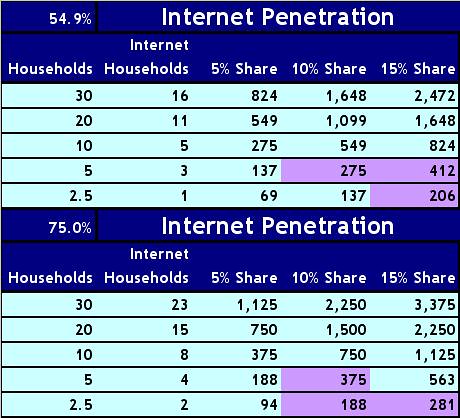

Much more important than the backhaul costs is the expected number of connections. As a ball park figure, Carphone say the breakeven figure is around 250 customers. For most unbundlers this will involve an estimate of internet penetration and market share. Again someone like Sky who is only marketing broadband services to its own PayTV base the risk will be reduced because they will know exactly how many payTV customers they currently have per BT exchange.

Also a big factor is this is whether there is a cable network in the area – cable has a high market share when it competes head on with ADSL services.

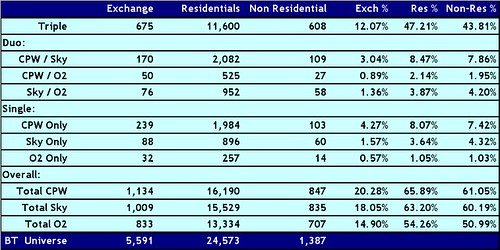

The other big consideration is how many other unbundlers are at each exchange:

Analysing the top 3 unbundlers shows a huge overlap in the exchanges that they are unbundling as represented by the Venn diagram above. The situation when combined with the household data is even more extreme:

I suspect that the data from the other large unbundler (C&W Access) would not be radically different from the above. The big question for the C&W coverage is how much of it overlaps with the Virgin Media cable network, because one would assume that Virgin Media will not market ADSL services where they have cable.

It also brings a big questionmark over the late unbundlers such as Tiscali and Orange – as more unbundlers are present in each exchange, the probability of them achieving the required minimum level of subscribers for profitability are reduced.

The source of the data is an analysis of residential and non-residential properties per exchange, sadly there is no data for Northern Ireland so the 668k NI residences are excluded. If anyone has this type of data (royalty free), please get in touch on the tittle-tattle line. This data is then correlated against BT exchange & post code coverage. This data is validated anytime someone makes a query against the samknows database and given over 4m queries have taken place the data is pretty accurate.

(Source: Samknows)

An analysis of this data gives that it is possible to cover 65% (approx. 15.8m) UK households by unbundling the 890 exchanges with more than 10k households. If all exchanges with greater than 5k households are unbundled, an additional 590 exchanges would yield 4.3m households – in total unbundling 1,480 exchanges gives 82% coverage or 20.1m homes.

Of course not all exchanges will be economic to be unbundled especially if the backhaul costs are pretty expensive. This will be dependent upon distance of the exchange from the local pop’s and availability of dark fibre at the exchange.

(Source: BskyB presentation for Morgan Stanley – 22nd March 2007)

For instance, a quick look at the Sky fibre backbone network explains why exchanges such as Exeter (38k) and Scunthorpe (32k) haven’t yet been unbundled by Sky despite the large volume of households. For Carphone, the situation is even worse with them only having three pops in Brentford, Birmingham and Irlam – the backhaul costs will be a limit on profits until a larger backbone is built.

Much more important than the backhaul costs is the expected number of connections. As a ball park figure, Carphone say the breakeven figure is around 250 customers. For most unbundlers this will involve an estimate of internet penetration and market share. Again someone like Sky who is only marketing broadband services to its own PayTV base the risk will be reduced because they will know exactly how many payTV customers they currently have per BT exchange.

Also a big factor is this is whether there is a cable network in the area – cable has a high market share when it competes head on with ADSL services.

The other big consideration is how many other unbundlers are at each exchange:

Analysing the top 3 unbundlers shows a huge overlap in the exchanges that they are unbundling as represented by the Venn diagram above. The situation when combined with the household data is even more extreme:

I suspect that the data from the other large unbundler (C&W Access) would not be radically different from the above. The big question for the C&W coverage is how much of it overlaps with the Virgin Media cable network, because one would assume that Virgin Media will not market ADSL services where they have cable.

It also brings a big questionmark over the late unbundlers such as Tiscali and Orange – as more unbundlers are present in each exchange, the probability of them achieving the required minimum level of subscribers for profitability are reduced.

<< Home