Nokia Music Centre, Mobile Operators and iPhones/iPods

One of features about the launch of the Nokia Music Centre (NMC) was that the various comments that Mobile Operators had failed in their attempts so sell music. Comments such as the one by Nomura analyst Richard Windsor in MobileToday are typical:

The Nokia Music Centre is basically a rejig of the Loudeye/OD2 service with tighter integration on some Nokia handsets. The initial US$60m acquisition of Loudeye/OD2 by Nokia did not meet with universal approval mainly because of the worry for conflict with the mobile operators.

Also, it should not be forgotten the struggles of Loudeye/OD2 before the Nokia acquisition and the struggles of OD2 before purchase by Loudeye. In their last quarterly financial statement (2006Q2) there was a qualification whether Loudeye/OD2 would be able to continue as a going concern without the Nokia deal. In fact the biggest three customers were Microsoft (28%), KPN (16%) and France Telecom (14%), showing that Loudeye/OD2 had a history of partnering with the telcos. Loudeye/OD2 had also lost several of their early important customers such as Coca Cola to iTunes.

I would also point out that NMC appears to be a very much a me-too service with absolutely nothing to differentiate the service apart from the Nokia brand and integration with the handset operating system. I would argue that the mobile operators have been very inventive with pricing and bundling of their music offerings with companies such as 3 including downloads as part of the monthly bundle and Vodafone with its RadioDJ service. I would also add that at least here in the UK, all the operators seem to invest a lot of marketing spending in the music industry especially with sponsorship of live concerts.

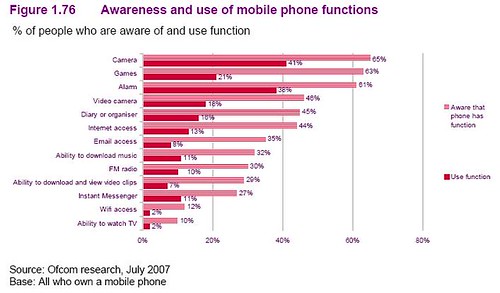

There is also some interesting data from a recent OFCOM survey.

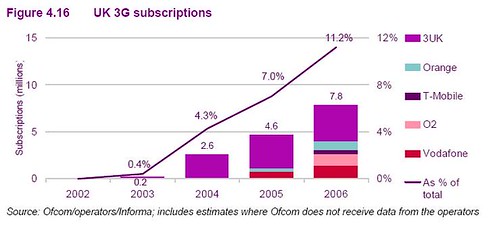

11% of mobile users in the UK download music onto their mobile phones. 11% of the mobile market may not seem a high percentage, but with near 100% population penetration, it is a very large number of around 7.5m people. The uptake is roughly tracking the number of 3G subscriptions sold. I wonder if iTunes have that many people actually downloading in the UK rather than ripping and sharing their CD record collections?

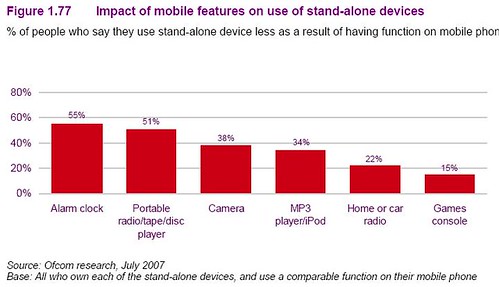

And this is before the number of people who are “sideloading” music from their personal music collections on the phones to listen to music. In fact, it is interesting that 34% of people actually see the mobile phone will reduce their use of MP3 players/iPods.

Perhaps, it was Steve Jobs who launched the iPhone from a weak position knowing that the iPod market would eventually be consumed by the locust like multi-purpose mobile device. The mobile phone has already done serious damage to the sale of analogue devices such as watches and alarm clocks in the UK. I actually think it is Steve Jobs brilliance that has allowed him to negotiate such ground breaking deals in partnerships with the mobile operators. Of course, it helps that Apple doesn’t have the legacy of the Nokia model for selling and distributing mobile phones.

I must admit to being totally confused as to why Nokia did not go down the partnership route with the operators. If Nokia were completely confident that the only potential successful path was without the operators, I would have expected them to launch the service in non-subsidised markets, where the operators do not have as much control over the software load on the handset and the moral right to demand preference to their favoured applications.

In summary, I don’t think the mobile operators are as in bad shape as many think, should not be too worried about the bad press in the week generated by the Nokia hype and keep on the current path playing for the long run. I also think on principle the mobile operators should block the Nokia Media Centre on all phones sold with a subsidy unless Nokia agree to a reasonable share of the revenues. If Nokia refuse to block the application, then the operators should have the confidence to not sell the product with a subsidy.

My other major comment is that people expecting huge margins from distributing copyrighted content in general and music specifically are living in cloud cuckoo land. As a real life telco example of a mature service, I would look to the premium call industry, where typically the content owner (eg TV show) gets 90% of the revenue, the distribution channel (eg the phone network) roughly 5% and the aggregator and campaign manager gets 5%. I agree margins are much higher in mobile premium calls than in fixed, but I think this will be only a temporary phenomena. Also, as far as I can make iTunes is a zero profit activity but generates huge profits on the device sales.

The only way someone outside of the record companies will make a lot of money in distributing music is if a fundamental rearchitecting of the music industry takes place.

The operators have fiddled and prevaricated for the last three years in terms of bringing the internet to the mobile screen and now the opportunity for them to add value by integrating internet services looks to have been squandered. A utility-like, low margin, bit-pipe future where the value accrues to handset vendors and internet companies looks likely to result.However, in the 1H 2007 results from Vivendi today owner of the biggest record company in the world, Universal Music Group, show a very different story.

Digital sales of €315m account for 15% of total revenues with 53% from online and 47% from mobile salesThe mobile operators must be doing something right.

The Nokia Music Centre is basically a rejig of the Loudeye/OD2 service with tighter integration on some Nokia handsets. The initial US$60m acquisition of Loudeye/OD2 by Nokia did not meet with universal approval mainly because of the worry for conflict with the mobile operators.

Also, it should not be forgotten the struggles of Loudeye/OD2 before the Nokia acquisition and the struggles of OD2 before purchase by Loudeye. In their last quarterly financial statement (2006Q2) there was a qualification whether Loudeye/OD2 would be able to continue as a going concern without the Nokia deal. In fact the biggest three customers were Microsoft (28%), KPN (16%) and France Telecom (14%), showing that Loudeye/OD2 had a history of partnering with the telcos. Loudeye/OD2 had also lost several of their early important customers such as Coca Cola to iTunes.

I would also point out that NMC appears to be a very much a me-too service with absolutely nothing to differentiate the service apart from the Nokia brand and integration with the handset operating system. I would argue that the mobile operators have been very inventive with pricing and bundling of their music offerings with companies such as 3 including downloads as part of the monthly bundle and Vodafone with its RadioDJ service. I would also add that at least here in the UK, all the operators seem to invest a lot of marketing spending in the music industry especially with sponsorship of live concerts.

There is also some interesting data from a recent OFCOM survey.

11% of mobile users in the UK download music onto their mobile phones. 11% of the mobile market may not seem a high percentage, but with near 100% population penetration, it is a very large number of around 7.5m people. The uptake is roughly tracking the number of 3G subscriptions sold. I wonder if iTunes have that many people actually downloading in the UK rather than ripping and sharing their CD record collections?

And this is before the number of people who are “sideloading” music from their personal music collections on the phones to listen to music. In fact, it is interesting that 34% of people actually see the mobile phone will reduce their use of MP3 players/iPods.

Perhaps, it was Steve Jobs who launched the iPhone from a weak position knowing that the iPod market would eventually be consumed by the locust like multi-purpose mobile device. The mobile phone has already done serious damage to the sale of analogue devices such as watches and alarm clocks in the UK. I actually think it is Steve Jobs brilliance that has allowed him to negotiate such ground breaking deals in partnerships with the mobile operators. Of course, it helps that Apple doesn’t have the legacy of the Nokia model for selling and distributing mobile phones.

I must admit to being totally confused as to why Nokia did not go down the partnership route with the operators. If Nokia were completely confident that the only potential successful path was without the operators, I would have expected them to launch the service in non-subsidised markets, where the operators do not have as much control over the software load on the handset and the moral right to demand preference to their favoured applications.

In summary, I don’t think the mobile operators are as in bad shape as many think, should not be too worried about the bad press in the week generated by the Nokia hype and keep on the current path playing for the long run. I also think on principle the mobile operators should block the Nokia Media Centre on all phones sold with a subsidy unless Nokia agree to a reasonable share of the revenues. If Nokia refuse to block the application, then the operators should have the confidence to not sell the product with a subsidy.

My other major comment is that people expecting huge margins from distributing copyrighted content in general and music specifically are living in cloud cuckoo land. As a real life telco example of a mature service, I would look to the premium call industry, where typically the content owner (eg TV show) gets 90% of the revenue, the distribution channel (eg the phone network) roughly 5% and the aggregator and campaign manager gets 5%. I agree margins are much higher in mobile premium calls than in fixed, but I think this will be only a temporary phenomena. Also, as far as I can make iTunes is a zero profit activity but generates huge profits on the device sales.

The only way someone outside of the record companies will make a lot of money in distributing music is if a fundamental rearchitecting of the music industry takes place.

![21cn_netstruct[1]](http://farm2.static.flickr.com/1200/1117599724_487cf4af0e.jpg)